Revenues and profits

Revenues and profits

Types of revenue

Total Revenue (TR): Total revenue is the amount of money that a firm receives from the sale of its goods and services. It is found by multiplying the price of a product by the quantity sold.

Average Revenue (AR): Average revenue is the revenue earned by a firm per unit sold. It is found by dividing total revenue by the quantity sold.

Marginal Revenue (MR): Marginal revenue is the additional revenue earned by the producer when selling one more unit of the good or service. This is found by dividing the change in total revenue by the change in quantity sold.

Types of costs

Total Cost (TC): Total cost is the total amount of money incurred by a firm from the expenditure of producing goods and services. It is found by totalling total fixed cost and total variable cost.

Total Fixed Cost (TFC): Total fixed cost is the total amount of money incurred by a firm from the expenditure of producing goods and service, more specifically, on the costs that do not vary with output.

Total Variable Cost (TVC): Total fixed cost is the total amount of money incurred by a firm from the expenditure of producing goods and service, more specifically, on the costs that vary with output.

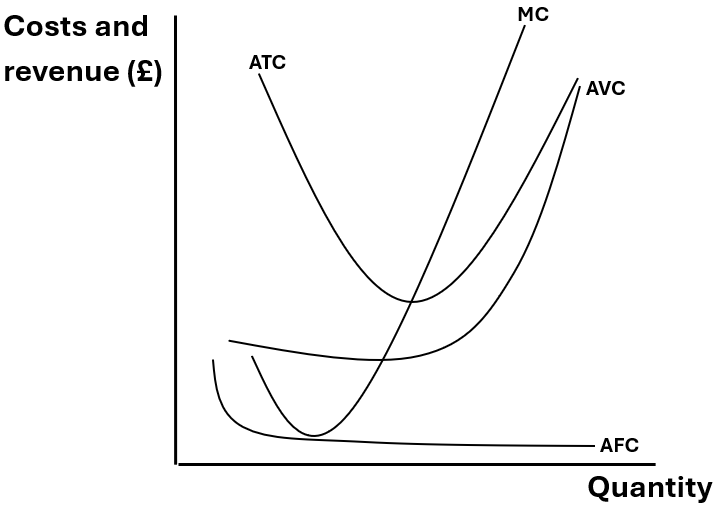

Average Cost (AC): Average cost is the total amount of money spent by a firm, per good or service produced. It is found by total cost divided by quantity produced.

Average Fixed Cost (AFC): Average fixed cost is the total amount of money spent by a firm on costs that do not vary with output, per good or service produced. It is found by total fixed cost divided by the quantity produced.

Average Variable Cost (AVC): Average variable cost is the total amount of money spent by a firm on costs that vary with output, per good or service produced. It is found by total variable cost divided by the quantity produced.

Marginal Cost (MC): Marginal cost is the extra amount of money spent on producing an extra good or service. It is found by dividing the change in total cost by the change in quantity.

Cost curves

Types of profit

Supernormal: Supernormal profits refers to the profit earned by a firm that is above the total cost of production. This occurs in markets that earn more than perfectly competitive markets, due to market power or efficiency.

Normal: Normal profits refer to the situation where the total revenue earned is the minimal amount that the firm needs to stay in business. This is when total revenue is equal to total cost.

Subnormal: Subnormal profits occur when a firm's total cost exceeds the total revenue made by the sale of goods and services. This is essentially when a firm is making a loss.

Shutdown conditions

A firm will shut down its operations in the short run if it cannot cover its total variable costs. However, if it can cover its total variable costs, but not its fixed costs it will continue to operate, since if it continues to produce, the fixed costs will not be incurred in full. In the long run, a firm will shut down if it cannot cover all of its costs, which is when its total revenue is less than its total costs.

Economies and diseconomies of scale

Internal economies of scale

Technical economies: Larger firms can invest and get more access to more advanced machinery or automation, which increases productivity in the firm thus reducing long-run average costs.

Financial economies: Larger firms can borrow at lower interest rates since they are more worthy consumers of credit in the eyes of a commercial bank due to them having greater income flows and collateral.

Marketing and purchasing economies: Bulk buying by larger firms can reduce input costs, and lower the average cost of each unit. Marketing costs are also reduced in larger firms since large-scale advertising spreads fixed costs over more units produced.

Risk-bearing economies: Diversification across products and different markets reduces the impacts of failure in one area.

Managerial economies: Specialisation of management roles can improve the efficiency and decision-making of a firm.

External economies of scale

Location: A cluster of firms in a region in the same market leads to shared infrastructure which can lower average costs. An example is Silicon Valley in California, USA.

Labour: A concentrated industry creates a pool of skilled workers in a specific location. This can reduce training costs for producers.

Diseconomies of scale

Managerial: Coordination and communication become more difficult between managers as a firm grows and becomes larger, leading to potential inefficiencies.

Cost of raw materials: Large increases in demand can manipulate the price of raw materials leading to an overall increase in the cost of raw materials.

Changes: Sudden changes in market demand or technology can make large-scale operations outdated thus increasing inefficiency.