Price, taxation, and subsidies

Price, taxation, and subsidies

The price mechanism

ARSI

ARSI is a useful acronym that shows the four key functions of the price mechanism in a free market economy. In a free market economy, these four letters are allocation of resources, rationing, signaling, and incentives. Each component works as follows:

Allocation of resources (A): The market price helps determine how resources are allocated in an economy using demand levels. For example, resources will be allocated to those goods with the most demand, which will have high prices. Conversely, the goods with the lowest prices, indicate that resources should be allocated elsewhere to areas of greater demand.

Rationing (R): The price mechanism rations out excess supply or demand for a good/service to those who most need it. For example, if a good has excess demand, the price will rise so that only those who are willing to pay more money, will get the product.

Signaling (S): Prices act as a signaling mechanism for producers and consumers. For producers, if prices are high, it may signal them to supply more and for consumers, if prices are low it can signal to them that the product is in low demand.

Incentive (I): Prices create incentives for consumers and producers. For producers, high prices may create an incentive to extend supply in pursuit of increased supernormal profits. For consumers, lower prices may increase the incentive to purchase a good, to maximise utility at the lowest price possible.

Consumer and producer surplus

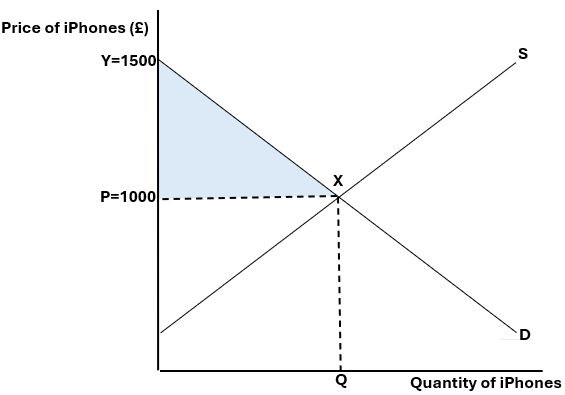

Consumer surplus

Consumer surplus is the difference in the market price of a product and the price which a consumer values the product. For example, if an iPhone's market value is £1000, but the consumer values it for £1500, the consumer surplus for this individual is £500. Consumer surplus is an important welfare measurement because, in this example, the consumer gains a personal "extra" value of £500, as they would have paid higher than they actually paid. It can be shown on a diagram below, in the area shaded PXY:

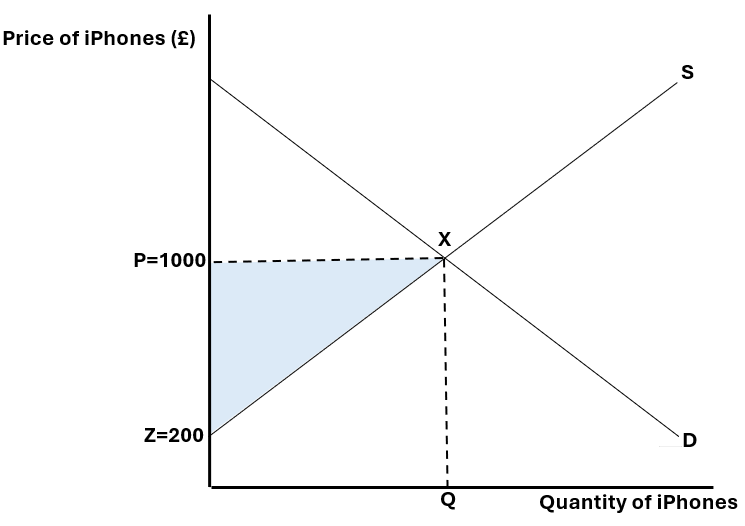

Producer surplus

Producer surplus is the difference between the market price of a product and the lowest price that a producer is willing to sell their product at. For example, if an iPhone is bought by a consumer for £1000, but the producer would have been willing to sell it at £200, then the producer surplus is £800 for this individual producer. This is shown on the diagram below in the area shaded PXZ:

Taxes and subsidies

Taxes

Direct taxes

A direct tax is a tax that is levied on an individual or organisation and paid directly to the government. This type of tax cannot be passed onto someone else and the entity that bears the tax burden must pay it themselves.

Indirect taxes

An indirect tax is a tax on spending. i.e. it's a tax that is applied to a producer that forces them to put up the price of the good or service in some way. Normally, the government places indirect taxes on goods and/or services that create negative externalities, also known as excise duties. This implementation is strategically employed to disincentivize the production or consumption of demerit goods or services. There are two types of indirect taxes:

Ad valorem taxes: This is a tax, where the amount paid is decided as a percentage of the value of the goods e.g. a 20% VAT

Specific taxes: This is a tax, where the amount paid is added to the price and does not change if the good changes in price e.g. a 50p excise duty

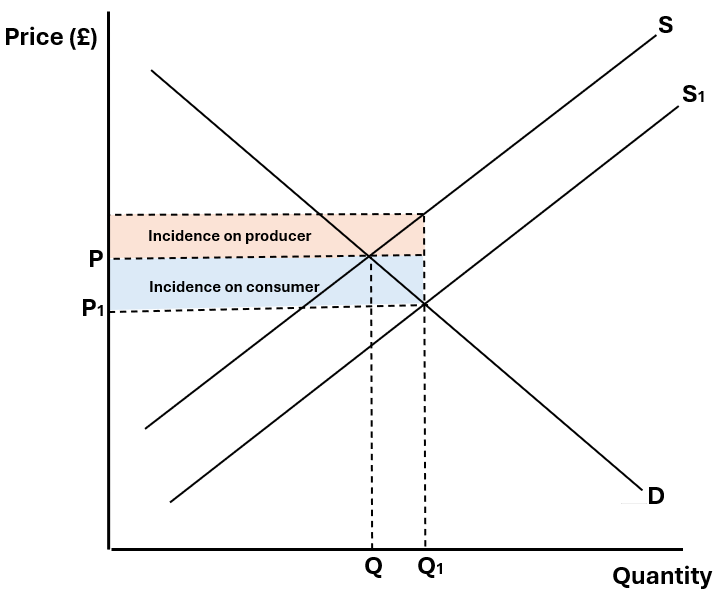

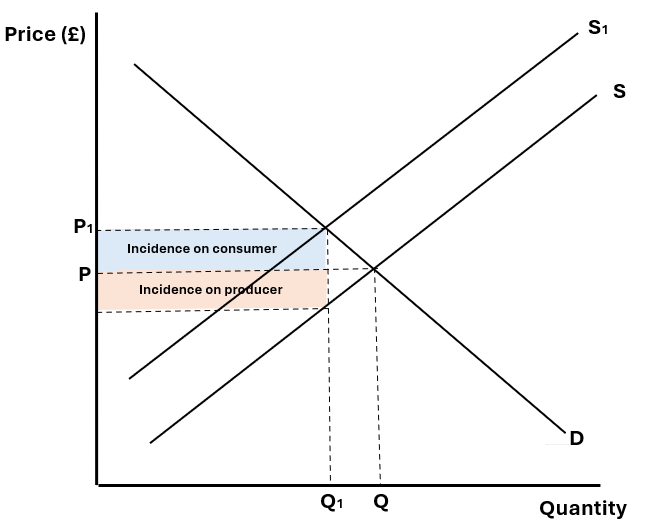

Diagrams showing the incidence of taxation

Ad valorem (unitary):

Specific (unitary):

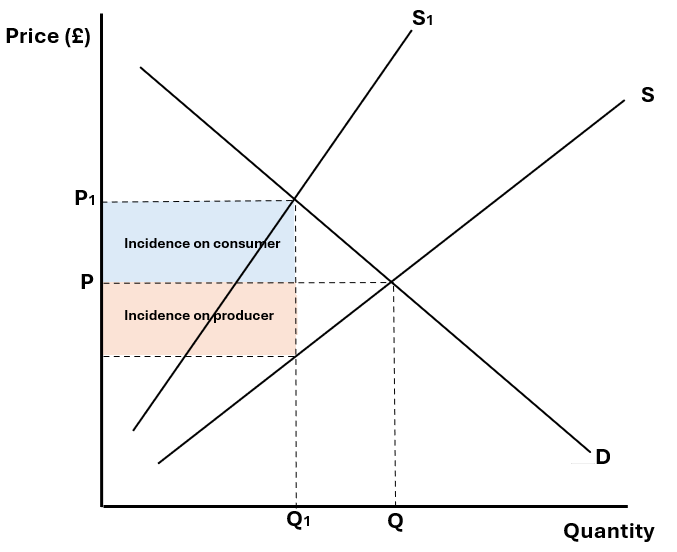

The effect of changes in PES and PED

PED relatively elastic and PES relatively inelastic: The incidence of tax mostly falls on the producer.

PED relatively inelastic and PES relatively elastic: The incidence of tax mostly falls on the consumer.

PED perfectly inelastic and PES perfectly elastic: The incidence of tax falls entirely on the consumer.

PED perfectly elastic and PES perfectly inelastic: The incidence of tax falls entirely on the producer.

Subsidies

A subsidy is a set amount of money given directly to a firm by the government to encourage consumption and production. In other words, the government pays part of the cost of the goods. A subsidy would be given to a staple good or a good that benefits society, for example, electric cars or the NHS. Subsidies are normally used by the government to increase consumption of merit goods and/or services, reducing market failure.

Diagram showing the effect of subsidies