An introduction to economics

An introduction to economics

Goods and services

Goods and services are the products produced in an economy. A good refers to the tangible products in an economy i.e. those products that can be seen or touched. A service refers to an intangible product that can not be seen or touched.

Ceteris paribus

Ceteris paribus is a latin term used by economists to isolate the effect of one variable on another while assuming that all other factors remain unchanged. The term ceteris paribus directly translates to "all other things being equal", and is crucial for simplifying complex economic models and theories.

Positive and normative economic statements

Positive statements

A positive economic statement is one that includes a fact. These statements can be validated by the use of data and empirical evidence. These statements describe what is in or what will be in the economy, without including opinions or judgements. For example, "the CPI rate of inflation in the UK, in May 2024 was 2.0%". This statement can be validated by UK data, and does not include an opinion.

Normative statements

A normative economic statement is one that includes a value judgement, or a statement that can not be validated by empirical evidence. They are subjective and often express opinions from the individual. For example, "the government should spend more on defence than healthcare". This statement can not be validated by data and provides a subjective opinion.

The basic economic problem

The basic economic problem is that there is not enough resources in the economy to satisfy the infinite desires of every consumer. Economies try to limit this problem by answering three questions. What should be produced? How should it be produced? And for whom should these products be produced for?

Renewable and non-renewable resources

Renewable resources: Renewable resources are those that can be produced at the rate that they are used. An example includes plants, which can be grown back at the rate that they are used.

Non-renewable resources: Non-renewable resources are those that can not be replenished at the rate which they are used. An example includes coal, since it can not be replenished at the rate of which it is used.

Opportunity costs

Opportunity costs occur when the next best alternative is given up when making an economic choice. For example, if a consumer has £5000 to spend on a vehicle, and has the choice between a car and a van then the vehicle that they choose not to purchase is the opportunity cost.

Factors of production

Factors of production are the resources in the economy that are used to aid production. Typically, factors of production are classified into four categories. They are:

Land: These are the natural resources in the economy that is used to aid production. Examples include farmland and mineral deposits.

Labour: This is the workforce of an economy in terms of its physical and mental efforts to produce goods and services.

Capital: This is the human made aids to production n an economy. An example can include machinery.

Enterprise: This is when an entrepreneur organises the factors of production to produce goods and services.

Production Possibility Frontiers (PPFs)

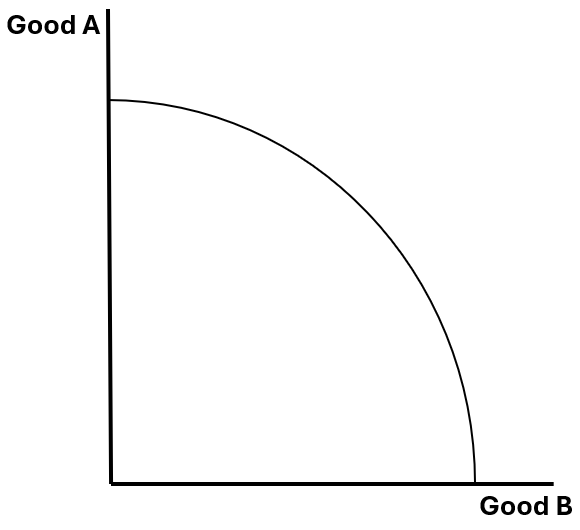

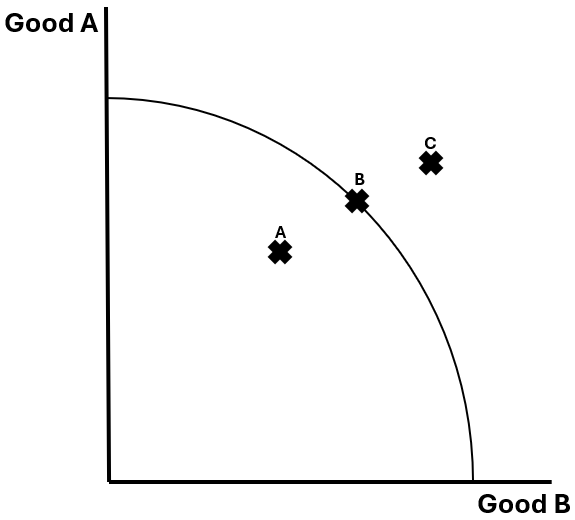

A PPF curve shows an economy's productive potential. It illustrates the maximum combination of two goods or services that an economy can produce if all production factors are fully utilised, demonstrating the economic concepts of scarcity and opportunity cost.

The potential of the economy

The economy will aim to produce at B, where economic efficiency is obtained. At A, the economy is producing at an inefficient level, where all factors of production are not being utilised. C is the point that is unobtainable, which is outside the PPF.

Opportunity cost

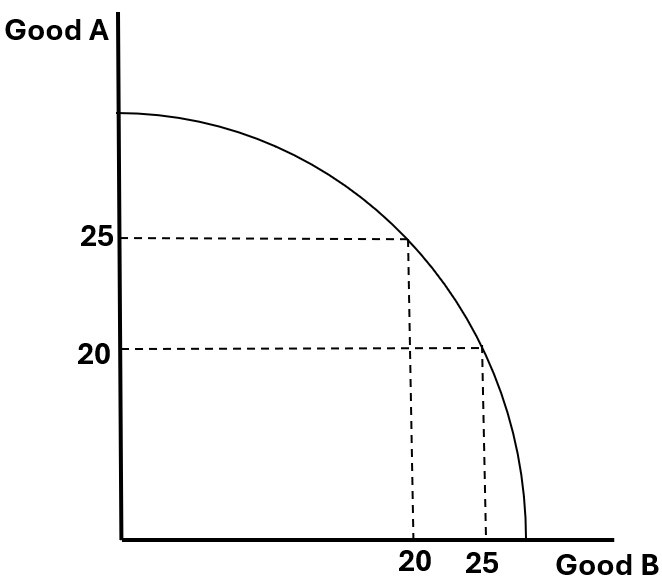

The opportunity cost is shown on a PPF when an economy shifts its resources elsewhere for production, thus creating an opportunity cost in producing the other combination goods. For example, on the diagram below, producing 25 units of good A creates an opportunity cost of 5 units for good B.

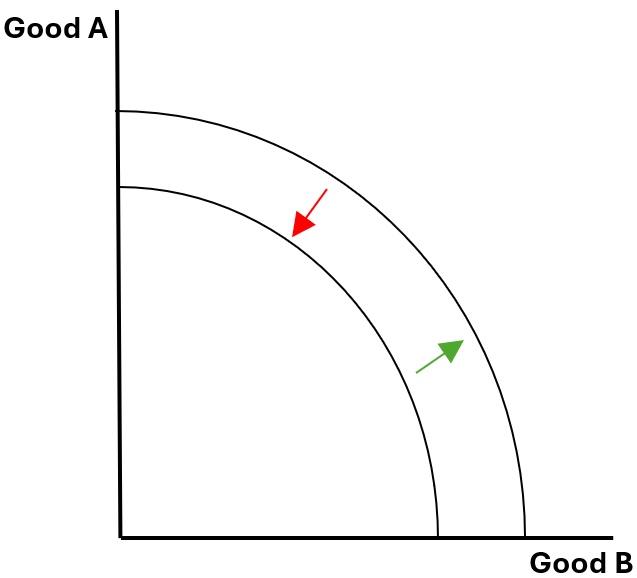

Economic growth and decline on a PPF

The green arrow represents an increase in economic growth, whereas the red arrow represents a decline in economic growth. This is because there are more factors of production in the economy, which when efficiently used, creates economic growth.

Movement of a PPF

Movement along a PPF occurs when an economy reallocates resources between the two goods in production. Moving up and down the curve indicates an increase in the production of one good and a decrease in another. This occurs when the economy remains efficient but changes focus between the two goods.

Capital and consumer goods

Capital goods: Capital goods are those in an economy used to produce consumer goods.

Consumer goods: Consumer goods are goods directly consumed after production by consumers.

Division of labour and specialisation

Division of labour

Division of labour occurs when labour is allocated to different parts of the production process.

Advantages of division of labour

Increased productivity: Workers who focus on a single task become more efficient at this task and become more skilled. This increases labour productivity in production.

Time efficiency: There is lots of time saved between switching tasks. This can also lead to increased efficiency in the workplace.

Disadvantages of division of labour

Boredom: When focusing on one specific task, workers may become bored and thus their productivity may decline.

Loss of skills for workers: By focusing on the same task, workers may become overspecialised in one part of the production process. This may lead to a loss of skills when looking to move jobs.

Increased vulnerability in the production process: If firms organise their production process, so that only a minimal quantity of workers can operate a specific task, then if those workers are absent, it can lead to severe disruptions in the production process.

Specialisation

Specialisation occurs when a person, organisation or entire country focuses on the products that they are best at producing.

Advantages of specialisation in trade

Increased global output: Countries focusing on producing goods that they are best at producing can lead to comparative advantage, which can lead to higher global efficiency.

Economic growth: By specialising in producing the goods that they are best at, countries may benefit from an increase in export revenue due to increased quality.

Disadvantages of specialisation in trade

Overdependence: A country may depend too much on one product, which can lead to vulnerability when the demand for this good fluctuates. This can leave countries in detrimental positions when the demand for their specialised goods is reduced.

Functions of money

Money is defined as any item or verifiable record that is widely accepted as a payment for goods and services or for the repayment of debts. Money is seen to have five main functions, which are as follows:

A medium of exchange: Money is used as something to exchange for goods and services. This removes the complexity of a barter economy and makes the transfer of goods and services much smoother.

A store of value: Money retains its value over time, which allows for entities to store it as wealth. However, it must be noted that inflation can erode the value of money over time, which can reduce future purchasing power.

Unit of account: Money provides a common measure of value among different goods and services, which allows for easier comparison. This helps to quantify the value of products, making trade more efficient.

Method of deferred payment: Money allows for consumers to enter into contracts where the payment is made in the future. This is because they have trust that the money today will still be used as a medium of exchange in the future.

Measure of value: This is closely related to the unit of account function but it can also include how money helps economic agents evaluate financial performance. This means it can allow for the establishment of financial concepts in the economy such as wages and investment values.

Types of economies

Free market economies

A free market economy is one where the decisions that involve investment, distribution or allocation of resources and the production of goods and services are decided by the market forces of supply and demand, without government interference. The pricing in a free market economy is completely decided by the price mechanism, and the government play a minimal role in regulating economic activities. There is no perfectly free market economy in the world, however, most western economies are close to it.

Advantages of free market economies

Efficiency: Since businesses compete to meet consumer demand, it is likely that the allocation of resources will be much more efficient than that of a command economy. Additionally, the incentive of profit in a free market economy is likely to drive firms to be more efficient.

Individual freedom: Consumers and businesses have the freedom to make their own economic decisions without government interference. This can include what they want to purchase, where they want to invest or where they want resources allocated to.

Innovation: Free markets provide the incentive to innovate since new businesses are always competing to gain market share from other firms in the market. This provides greater profits for businesses that are successful in innovation and provides more consumer choice.

Disadvantages of free market economies

Income and wealth inequality: Since success in a free market depends on one's ability to compete, if certain groups of people out compete another group for large time periods, it can great vast disparities between different social groups in terms of their wealth and income earned. This can create social fragmentation and lead to reduced economic growth.

Market failure: Sometimes, in a free market economy it is possible that the market fails to allocate resources efficiently. This could lead to the under allocation of merit goods, or the over consumption of demerit goods which can lead to increased negative externalities.

Exploitation of workers: Since the incentive of profit is what drives free market economies to function, firms may look to constantly cut costs including their labour costs. This can lead to extremely low wage rates and therefore the exploitation of workers occurs.

Command economies

A command economy is where a central authority makes all the economic decisions. This means that there is lots of government regulation on economic activities, the prices of goods and services is primarily decided by government regulation, and the allocation of resources is centralised. Examples of command economies include that of North Korea.

Advantages of command economies

Income and wealth equality: Mass regulation by a centralised body can lead to the rewards of income and wealth being distributed equally among the population. This reduces social fragmentation between society.

Stability: Since a centralised authority is involved in all of the economic decision making, it can lead to less fluctuation in the economy. This may be advantageous if the economy can avoid large boom and bust periods in the economic cycle.

Increase in wellbeing: Command economies are not driven by the incentive of profit like free market economies, but are driven by the incentive of improving the wellbeing of a country.

Disadvantages of command economies

Decreased efficiency: Since everyone receives the same wage, no matter what job they are in, it can lead to a lack of motivation among the workforce. This can lead to decreased productivity and thus reduced efficiency in the economy.

Loss of freedom: Consumers and businesses have a lack of freedom of choice in terms of their economic decisions, due to the centralised authority being in control of the economy. This can lead to a loss in welfare for economic agents.

Corruption: Since the concentration of economic power lies in one centralised authority, the individuals in government may use their power to benefit themselves, leading to inequality, inefficiency and an overall decrease in wellbeing for its citizens.

Mixed economies

A mixed economy is one that combines aspects of a command economy and a free market economy. It usually uses the price mechanism to determine pricing and wages and allows individuals and businesses to make their own economic decisions, however, if the government believe that market failure occurs from this, it will intervene to try and reduce it. The government may also intervene before market failure occurs, trying to stop it from happening.