Market failure and government intervention

Market failure

Market failure occurs where the free-market equilibrium does not lead to a socially optimal allocation of resources such that too much or little of the good is produced.

In some cases, intervention of the government would be needed to address the causes of market failure and correct it whilst promoting stability and welfare. However, this belief lies on the school of economic thought one follows. For example, Laissez-Faire economists would believe that a free market, driven by the market forces of supply and demand, would eventually be able to correct the market failure naturally.

But even if intervention is needed, each government intervention method varies according to the specific type of market failure present.

Categories of market failure

- Externalities: This is the effect that a third party receives from an economic transaction. These effects can incur from production and consumption of goods are defined as either positive (beneficial) or negative (harmful).

- Under-provision of public goods: The under-provision of public goods occurs when the market fails to supply goods and services that are non-excludable and non-rivalrous, leading to the free-rider problem and an inadequate provision of these goods from private producers.

- Information gaps: This occurs when one economic agent has more knowledge about a product than another, leaving them at a disadvantage.

It is important to note that other factors can be considered as market failures such as inequality gaps, emergence of monopolies and unemployment, all of which can be caused by allowing markets to run freely without intervention.

Externalities

Private, external and social costs and benefits

- Private cost: This is the cost resulting from the consumer or producer that is directly involved in the transaction.

- External cost: This is the cost that falls on entities that have no direct involvement in the economic transaction (third parties).

- Social cost: This is the cost to society as a whole as a result of the economic transaction that has been made. This takes into account the private costs to the consumer (resulting from consumption) or producer (resulting from production), added to the external cost to those not involved in the initial activity.

social cost = private cost + external cost

- Private benefit: This is the benefit resulting from the consumer or producer that is directly involved in the transaction.

- External benefit: This is the benefit that falls on entities that have no direct involvement in the economic transaction (third parties).

- Social benefit: This is the benefit to society as a whole as a result of the economic transaction that has been made. This takes into account the private benefits to the consumer (resulting from consumption) or producer (resulting from production), added to the external benefit to those not involved in the initial activity.

social benefit = private benefit + external benefit

Merit and demerit goods

- Merit goods: A merit good is a good where external benefits arise from production or consumption. Usually, these external benefits are greater than the private benefit that directly affected the entity involved in the economic transaction.

- Demerit goods: A demerit good is a good where external costs arise from production or consumption. Usually, these external costs are greater than the private costs that has directly affected the entity involved in the economic transaction.

Externalities diagrams

- MSB: Marginal Social Benefit to society.

- MPB: Marginal Private Benefit to those involved in the economic transaction.

- MPC: Marginal Private Cost to those involved in the economic transaction.

- MSC: Marginal Social Cost to society.

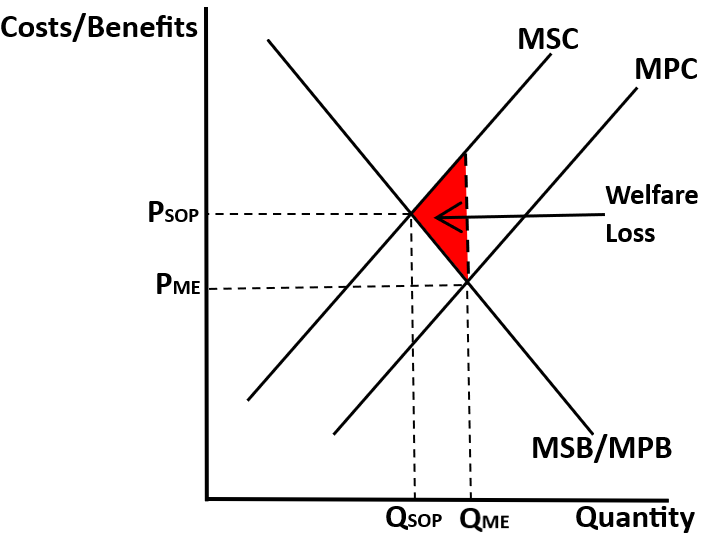

Negatives externalities diagram: overproduction or overconsumption

Negative externalities occur when social costs exceed private costs, as a result of production or consumption. The quantity that the good or service is currently being consumed or produced at, is QME, which shows an overconsumption or production of the good or service, as it is currently higher than QSOP (the socially optimum amount of consumption or production, where the private costs=social costs). This leads to a total welfare loss, shown by the red triangle, where that is how much society is losing out as a result of the over consumption or production of the product.

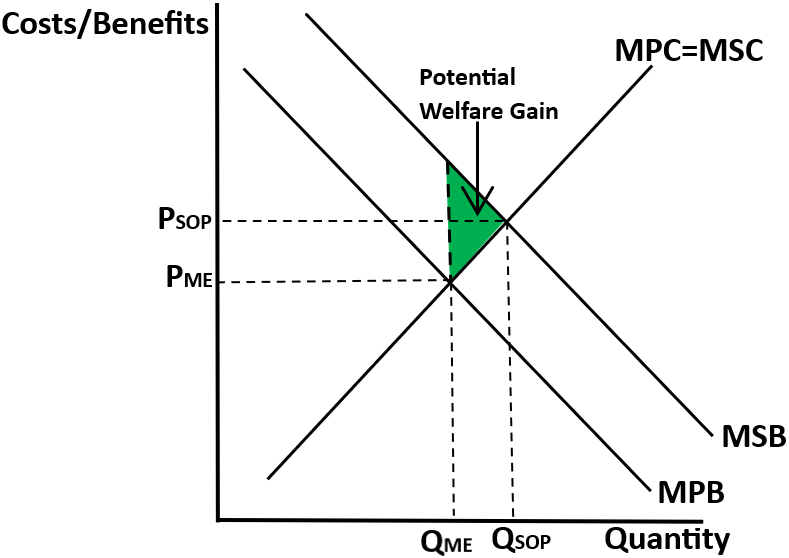

Positive externalities diagram: underproduction or underconsumption

In a free market economy, merit goods are usually under consumed, shown by the diagram below:

The goods shown in this diagram are currently being under consumed or under produced at QME, whereas it should be at the socially optimum level, QSOP. This means that there is currently societal benefits on third parties that are currently being missed out on due to underconsumption or production, showed by the green triangle. This represents the total welfare that a society could gain if this good was consumed or produced at the socially optimum level.

To encourage production and consumption at the socially optimum level, the government could:

- Pass laws to reduce negative externalities

- Use a pigouvian tax to reduce negative externalities

- Use a subsidy to increase positive externalities

- Provide information to increase positive externalities or reduce negative externalities

Public goods

Public goods: A good provided without profit, where the ownership is not restricted to those that purchase it.

Private goods: A good provided with profit, where the ownership is restricted to those who purchase it.

Rivalrous:

- Rivalrous: The consumption of this good by one person reduces the amount available for consumption by another person.

- Non-rivalrous: The consumption of this good by one person does not reduce the amount available for consumption by another person.

Excludability:

- Excludable: Producers prevent the consumption of this good or service through their ability to pay.

- Non-excludable: Producers do not or can not prevent the consumption of this good or service through a consumer's ability to pay.

Public goods are non-rivalrous and non-excludable in that they do not reduce the amount available for consumption for others when consumed, and the ownership is not restricted by purchasing it, as the goods are publically provided at no cost.

Examples of public goods:

- National defence: If a country is protected from invasion, it benefits everyone in the country. Consumption can not be stopped from others using it, and it does not have a direct cost from the consumer, making it a public good.

- Street lighting: If light is provided in the night, it benefits individuals when walking at night. Consumption can not be stopped from others using it, and it does not have a direct cost from the consumer, making it a public good.

- Police services: If law and order is provided by the state, everyone in the community is benefited from increased security and reduced crime. Consumption can not be stopped from others using it, and it does not have a direct cost from the consumer, making it a public good.

- Flood defences: If flood defences are implemented, everyone is benefited from increased safety from erosion or when tsunamis occur. Consumption can not be stopped from others using it, and it does not have a direct cost from the consumer, making it a public good.

Quasi-public goods

These are public goods which have elements of non-excludability and non-rivalrous, within them but are not completely non-excludable and non-rivalrous. An example is roads, where once provided, the afterwards consumption of them is not limited to others after initial consumption. However, when using the road, the benefit provided to the consumer may be reduced if congestion occurs, making roads partially rivalrous at times.

Schools of economics on the provision of public goods

- Classical economists: Classical economic theory suggests that public goods are not provided by the free market (a market with no government intervention), but exceptional circumstances exist, where individuals may voluntarily conjoin to provide public goods that benefit society.

- Behavioural economists: Behavioural economic theory suggests that individuals in an economy have more motivation than just money or profit. This means that producers may provide public goods at a loss, fueled by other motivations such as generally helping society.

- Austrian economists: Austrian economic theory uses the theory of spontaneous order, which suggests that complex systems like the economy are able to run freely without government intervention. This means that goods and services can be efficiently allocated, including public goods, whether that be through voluntary acts or any other methods of allocation.

The free rider problem

A free rider is someone who receives a benefit, without paying for the good. The free rider problem is a type of market failure that occurs when consumers do not pay their share from the consumption of public goods. This disincentivises producers to produce them due to no profits being made, resulting in no public goods being provided. This means that the government has to intervene and provide these public good, thus correcting the market failure.

Information gaps

Information gaps occur in an economic transaction when one party has more knowledge about the product at exchange, than the other party involved, which is also called a problem of asymmetric information. This problem can be extended by persuasive and misleading advertisement. Examples of asymmetric information could be: if a mechanic overcharged a consumer for repairs to their car or a taxi in a foreign country charging large sums of money for a short journey.

Information gaps can be filled by the internet, or by the government providing information to consumers. For example, users on social media such as instagram or tiktok may advise individuals to not visit certain places due to prior experiences where they have not recieved a good value for their money.

Government intervention

Government intervention refers to the actions taken by governments around the world, aiming to influence and/or regulate activities within an economy. This can include a variety of methods, such as regulations, taxes and subsidies. These approaches hold the intent of correcting market failures or achieving specific objectives.

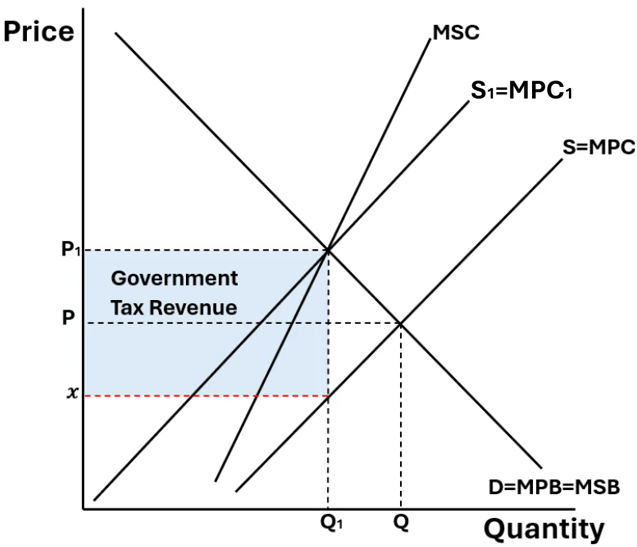

Indirect taxes

An indirect tax is a tax on spending. i.e. it's a tax that is applied to a producer that forces them to put up the price of the good or service in some way. Normally, the government places indirect taxes on goods and/or services that create negative externalities, also known as excise duties. This implementation is strategically employed to disincentivize the production or consumption of demerit goods or services. This would reduce market failure as the price would be pushed up, meaning that output would fall to a more socially optimum level. Both types of indirect taxes are applicable to correct market failure, Ad Valorem or Specific.

As shown on the diagram: A newly induced tax will cause a fall in supply and increase costs to an individual so S=MPC shifts to S1=MPC1. The free market produces at PQ, where MPC=MPB but the socially optimum position of production is at P1Q1, where MSB=MSC. The equilibrium position is now S1=MPC1=MSC=MSB. Therefore, the tax internalises the externality and social welfare is now maximised.

Advantages of using indirect taxation

- Increased government revenue: It generates government revenue meaning that the government could increase spending on education, healthcare and other areas.

- Social welfare maximisation: The externality is internalised and so the market can produce at the social equilibrium and social welfare is maximised.

- Reduced tax evasion: Due to the nature of indirect taxation being hidden within the prices of goods and services, it is more challenging for evasion, unlike direct taxes, which are easily evaded due to taxation on income or assets, taxed directly from the taxpayer.

- Effect on the economy: Indirect taxes on demerit goods or services can influence consumer behavior and market dynamics, leading to a positive economic effect. For example, taxes on cigarettes can help reduce consumption and improve public health, potentially leading to a national working life age extension.

- Impact on net trade: Custom duties, an indirect tax, can be used to regulate net trade, protecting domestic industries whilst generating revenue from international trade activities, leading to a current account surplus.

Disadvantages of using indirect taxation

- Measurement issues: Hard to set the specific amount of tax because it may be hard to measure the effect of an externality due to information gaps.

- Creation of a black market: Illicit traders can exploit the price differentials created by high indirect taxes to profit from the sale of smuggled goods, from foreign countries with lower tax rates, creating a black market.

- Political effect: Political parties may be reluctant to introduce a tax, due to increased taxes usually leading to decreased supporters, despite it being morally correct.

- Income inequality: The poor are more likely to spend larger proportions of their income, meaning nominally, they are more affected by indirect taxes than the rich due to the regressive nature of indirect taxes. This may lead to the expansion of income inequality.

- Economic distortions: Indirect taxes may distort consumer choices due to the influence of relative prices of goods and services, leading to possible inefficiencies in the allocation of resources. This is especially true if taxes are applied inconsistently across different industries, or products.

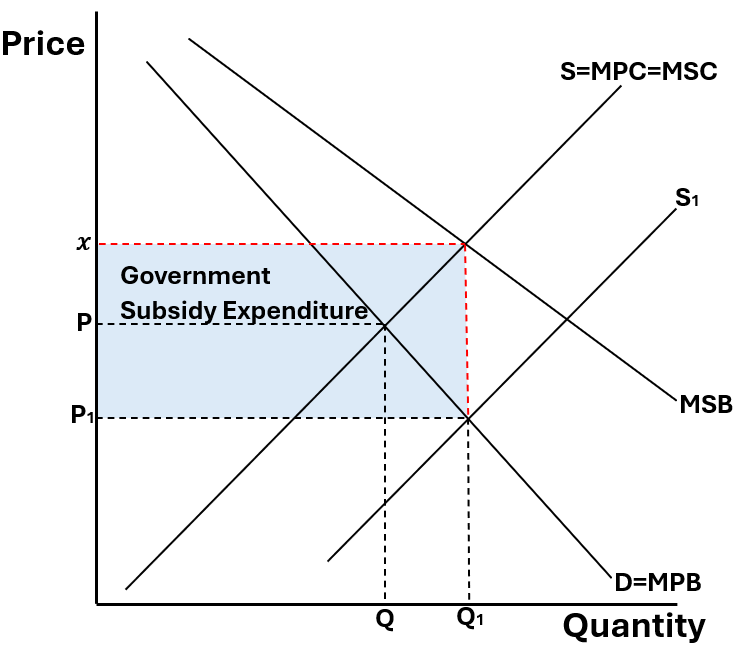

Subsidies

A subsidy is a set amount of money given directly to a firm by the government to encourage consumption and production. In other words, the government pays part of the cost of the goods. A subsidy would be given to a staple good or a good that benefits society, for example, electric cars or the NHS. Subsidies are normally used by the government to increase consumption of merit goods and/or services, reducing market failure. This is because if a subsidy is applied to a merit good, supply will shift outwards resulting in the new equilibrium being closer to the socially optimum equilibrium. This results in the price of the merit goods falling, and the quantity increases towards the social optimum, extending demand and thus consumption for merit goods.

Advantages of using subsidies

- Social welfare maximisation: Subsidies can maximize social welfare by making merit goods and services more affordable for low-income individuals, reaching the social optimum level of output.

- Promoting private sector research: Subsidies for research and development (R&D), projects that address market failures, may help to correct them, by providing the financial stability needed to understand more about causes, and possibly solutions of market failures. For example, subsidising R&D into the long-term effects of vaping, may help to reduce future market failure.

- Promoting financial equality: Subsidies targeted at low-income households, or disadvantaged groups can address financial equality issues, and promote social inclusion.

- Promoting the production of merit goods: Subsidies usually lower the average cost of production for firms, allowing them to maximise profit. If subsidies are implemented in merit good industries, it may incentivise further producers to enter this market, extending the supply of merit goods.

- Information asymmetry: Subsidies may fix information asymmetry between consumers and producers, by providing incentives for transparency and assurance of quality due to increased profits.

Disadvantages of using subsidies

- Opportunity cost: The implementation of subsidies may create an opportunity cost elsewhere in the economy, creating other potential problems. For example, subsidies on merit good industries may create an opportunity cost on the defence of a country, decreasing safety from invasions.

- Measurement issues: It may be hard to set the specific subsidy, referring to the sector it is placed in, as well as the amount because it may be hard to measure the effect of an externality due to information gaps.

- Dependency: Subsidies may be the reason that some producers are breaking even, therefore, if the subsidies are removed, it may result in the fall of a sector. This could lead to potential structural unemployment.

- Increased externalities: By reducing the costs of environmentally damaging practices, subsidies may undermine producer efforts to promote sustainability within their production process and mitigate environmental externalities.

- Distortions in trade: Subsidies can distort international trade as it provides unfair competitive advantages to domestic producers, by allowing them to be more price competitive, diminishing trade relations. This may harm other unsubsidised domestic industries involved with foreign trading partners, increasing their costs of production.

Minimum and maximum prices

For a maximum price to take effect, it is implemented under the equilibrium price, but for a minimum price to be effective, it needs to be imposed above the equilibrium price. In practice, maximum and minimum prices have been implemented globally. For example, rent control in Manhattan, New York has had a maximum price imposed and Scotland has had a minimum price enforced on alcohol.

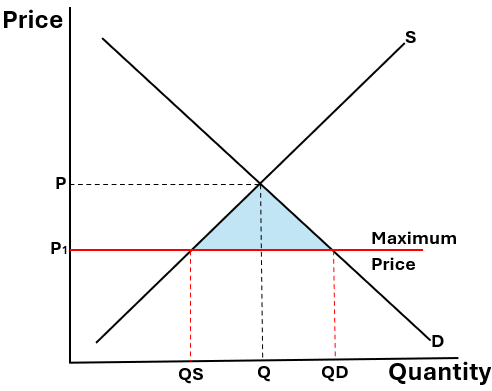

Maximum prices

A maximum price is usually established for a product exhibiting positive externalities, and is used to increase its affordability. Additionally, it may serve as a safeguard against monopolies exploiting consumers. This ceiling price often results in a situation where Quantity Demanded (QD) surpasses Quantity Supplied (QS), leading to excess demand.

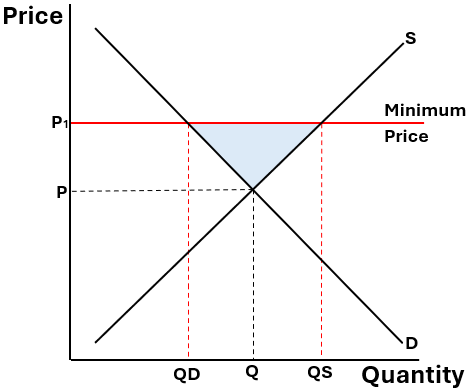

Minimum prices

A minimum price is usually established for a product exhibiting negative externalities, and is used to decrease its affordability. This price floor often results in a situation where Quantity Supplied (QS) surpasses Quantity Demanded (QD), leading to excess supply.

Advantages of maximum and minimum prices

Social Welfare Increase: Both maximum and minimum prices can increase social welfare as they can be implemented where the Marginal Social Benefit (MSB) is equal to the Marginal Social Cost (MSC).

Maximum prices

- Income equality: Maximum prices can benefit lower-income households, as it ensures access to essential goods and services at affordable prices. This therefore reduces income inequality, as the poor do not have to spend large proportions of income on necessities, enhancing social welfare.

- Consumer protection: Maximum prices prevent producers from supplying goods and services for excessively high prices, ensuring affordability and protecting consumers from exploitation, which is especially important in highly concentrated markets.

- Price stability: Maximum prices can help stabilize the general price level. This is due to its ability to prevent sudden spikes or fluctuations in prices, reducing cost-push inflation. Additionally, this is especially important for products with inelastic demand or limited substitutes.

Minimum prices

- Production incentives: Minimum prices may incentivise the production of goods and services. This is possible due to the definite outcome that producers receive a sufficient reward for their efforts, incentivising new producers to enter the market.

- Market stability: Minimum prices can prevent prices from falling below production. With the maintenance of a stable price floor, it can help ensure the availability of goods and services and prevent market disruptions.

- Producer protection: Minimum prices guarantee a certain level of income for established producers in the market due to the implementation of a floor price below which products cannot be sold. This provides financial protection for producers and ensures a fair return on their efforts.

Disadvantages of maximum and minimum prices

Measurement issues: It may be hard to set the price floor or price ceiling because it may be hard to measure the effect of the externality that the government are trying to reduce, due to information gaps.

Maximum prices

- Creation of a black market: Maximum prices may lead to shortages in supply for a certain product, due to the incentive of profit being reduced. This may lead to illicit producers selling these products above the price ceiling to maximise profit.

- Shortages in supply: Maximum prices may lead to shortages, particularly when the price ceiling is set below the market price, determined by the equilibrium point of supply and demand. Therefore, suppliers may not have the willingness or ability to supply goods at the chosen price, leading to excess demand and thus shortages.

- Changes in quality: A price ceiling may lead to decreased profits for producers in the affected sectors. This may lead to decreased incentives for innovation, leading to a decrease in the quality of products sold.

Minimum prices

- Overproduction: If the price floor is above the market price of the product, determined by market forces, it may lead to a demand deficit for the product produced, leading to excess supply and unsold inventories.

- Decrease in consumer surplus: Minimum prices may reduce consumer surplus by setting prices above the equilibrium of supply and demand. Furthermore, price floors transfer surplus from consumers to producers, leading to a decrease in overall welfare.

- Reduced competition: If the minimum price set is still very high, it may create Cost Disadvantages Independent of Size (CDIS) barriers to entry, creating highly concentrated markets, and distorting a fluid allocation of resources that would occur due to a large amount of producers.

Tradeable pollution permits

A tradeable pollution permit grants firms the authorization to emit a predetermined quantity of pollution, allocated by the government. Firms are obligated to purchase these permits, and to minimize expenses, companies decrease pollution output to avoid purchasing additional permits. Furthermore, these permits are exchangeable among firms for monetary compensation, which creates further pollution reduction efforts, as firms can profit by selling surplus permits. Due to the inelastic demand for these permits, firms can impose excessive prices on them. It is important to note that the supply of pollution permits is perfectly inelastic as there is a fixed quantity of permits available, distributed by the government.

Advantages of tradeable pollution permits

- Maximisation of social welfare: The number of pollution permits is capped, so it is guaranteed that the external cost of pollution will be reduced, allowing the maximisation of social welfare.

- Government revenue: Governments can generate revenue from the sale of pollution permits. The revenue earned from the sale of these pollution permits may be used to fund the provision of public goods, reducing market failure.

- Encourages investment in green technology: Due to firms being able to trade pollution permits, it means that there is an incentive to sell permits to other firms to generate extra revenue. This means that firms may invest in green technologies to be able to sell off their surplus pollution permits, leading to environmental sustainability.

Disadvantages of tradeable pollution permits

- Opportunity cost: Pollution permits are very expensive to monitor, meaning that there may be an opportunity cost on other ways to reduce emissions, such as subsidies for green technology research, or the reduction of tax for green industries.

- Effect on consumers: Pollution permits may raise costs significantly for high polluting producers, such as manufacturers, leading to high costs of production, that may be passed onto consumers, meaning consumers are not able to purchase as many goods and services as they could previously.

- Competitive advantages: Tradeable permits may only benefit certain industries, leading to uneven impacts. Industries with better access to permits may gain a competitive advantage, while industries with limited access to permits may face higher costs creating inequalities within the economy.

Public goods provision

Public goods, being both non-rivalrous and non-excludable, give rise to the free rider problem, and consequently, they are typically not supplied by the private sector or free market mechanisms. Instead, the government funds the provision of these merit goods through tax revenue.

Advantages of public goods provision

- Corrects market failure: The provision of public goods may correct market failure, as it may address the Free-Rider Problem and reduce externalities. This may also improve social welfare.

- Equality: When public goods are provided by the state, it may ensure that everyone has access to them, regardless of anyone's ability to pay. This reduces social disparities and promotes equality.

- Efficiency: State provision may achieve economies of scale, where the average cost per unit is reduced, with increased production. It also may decrease duplication of resources by centralizing the provision of public goods and using them advantageously.

Disadvantages of public goods provision

- Productive inefficiency: Due to decreased incentives in the public sector, with no motivation for profits, it may lead to inefficient production of state funded goods, not being able to keep up with demand. This may lead to the private sector providing goods, due to higher productive efficiency.

- Opportunity costs: The provision of state funded goods may provide extremely high administration costs, especially for particularly large populations. This may lead to an opportunity cost on other sectors of the public sector.

- Bureaucratic inefficiency: Public sector agencies responsible for the provision of public goods could experience bureaucracy, or red tape, leading to slow decision-making and production processes. This leads to delays, thus reducing the efficiency of public goods provision.

Provision of information

When the market failure of asymmetric information occurs, the government may intervene and provide information to put both parties in an economic transaction in more equal positions, in terms of knowledge about the product. They can also do this by forcing companies to provide information about their product.

Advantages of the provision of information

- Corrects market failure: Information provision by the state may be able to correct market failure by addressing information asymmetry, which occurs when one party in a transaction has more or information than another, leading to inefficient outcomes, and inefficient allocation of resources.

- Consumer protection: May correct information gaps for consumers, allowing them to act rationally, and get the best prices for their products that they demand.

- Promoting competition: State provided information may include state funded research, that supports technological advances. This may allow “Creative Destruction” theory to occur, fostering innovation and encouraging new entrepreneurs to enter the market.

Disadvantages of the provision of information

- Opportunity costs: Information provision may be very expensive, when considering the provision by mail, advertisement or other sponsored activities. This may create opportunity costs within the public sector.

- Incorrect information: The state does not always follow perfect rationality in their decision-making, and sometimes the information that they provide could be wrong. This does not correct market failures but may even worsen them.

- Information overload: State provided information may come in large quantities, thus overwhelming individuals and leading to people ignoring information, leading to increased market failure.

Regulation

Governments may implement laws and caps that ensure that social welfare is maximised. The government has also introduced regulatory bodies in the UK, such as OFWAT (water) or OFCOM (communications).

Advantages of regulation

- Environmental conservation: Regulation may support environmental conservation by implementing rules or limits relating to pollution or other harmful factors. Part of this may be reducing externalities, correcting market failure.

- Fair competition: Regulation stops the practices of anti-competitive behaviour, such as cartels forming, that may exploit the market, and take advantage of consumers. This reduces information gaps, helping correct market failure.

- Labour protection: Regulation in the labour market, may ensure fairer wages, or more stable working conditions. This may lead to increased job satisfaction, leading to increased productivity and positive economic effects. An example is raising the National Minimum Wage (NMW).

Disadvantages of regulation

- Bureaucracy: Excessive regulation can create vast bureaucracy and red tape, slowing down production processes, and thus leading to a potentially inefficient distribution of resources.

- Barriers to entry: Regulation may make it hard for new firms to enter markets due to barriers to entry. This may lead to highly concentrated markets, and a less efficient distribution of resources, that may occur in sparsely concentrated markets.

- Regulatory arbitrage: Regulatory arbitrage occurs when producers can find loopholes in regulations, allowing them to gain competitive advantages over other producers in the market. This may also lead to highly concentrated markets, leading to a less efficient allocation of resources.

Government intervention for competition

Competition and Markets Authority (CMA)

The CMA is a non-ministerial government run department in the UK. They work to promote competition in the market and investigate mergers and acquisitions that may exploit consumers or be seen as too anti-competitive, with the power to stop them if they are seen as harmful. They are also able to impose criminal cases and penalties to anti-competitive firms who have been involved in collusive behaviours or cartels.

Controlling mergers

In the UK, mergers undergo examination, tailored to the specific scenario of each investigation, with a primary focus on whether there will be a Substantial Lessening of Competition (SLC), as a result of the merger. The CMA will carefully evaluate the anticipated merger including the effects of it upon economic agents and its competitors, juxtaposed with the scenario that the merger has never occurred, allowing them to see the full effect of the merger. The approval of the merger relies on whether the benefits of this transaction outweigh the costs.

A merger triggers investigation if they result in a market share exceeding 25%, or if they meet the turnover threshold of a combined turnover of £70 million plus, with the main goal being the prevention of consumer exploitation through higher prices or poorer quality. Overall, the CMA can stop firms from gaining monopolistic power, but very few mergers each year are actually investigated each year.

Controlling monopolies

Profit regulation

Profit regulation is a regulatory mechanism used in highly concentrated markets such as monopolies. Under profit regulation, regulators set specific prices so that these monopolistic firms can charge for their goods and services, with the aim of ensuring that they earn a fair rate of return on their investments, whilst also considering the protection of consumers from excessively high prices.

For example, in the US, "rate of return" regulation is popular, where prices are set in a market that take into account the coverage of production costs with a rate of return on capital investment and the consumer. This encourages investment as firms are allowed to charge higher prices depending on their capital investment, but also may lead firms to shed labour thus creating unemployment.

Price regulation

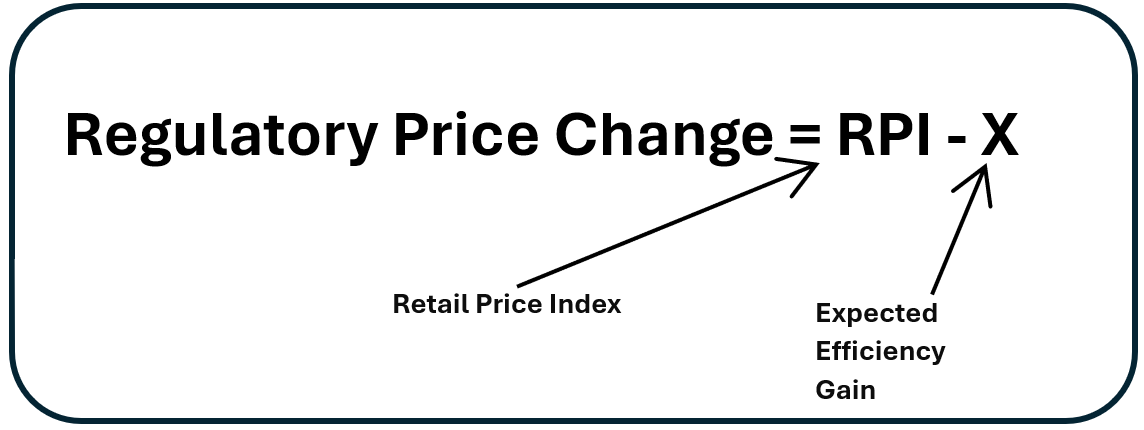

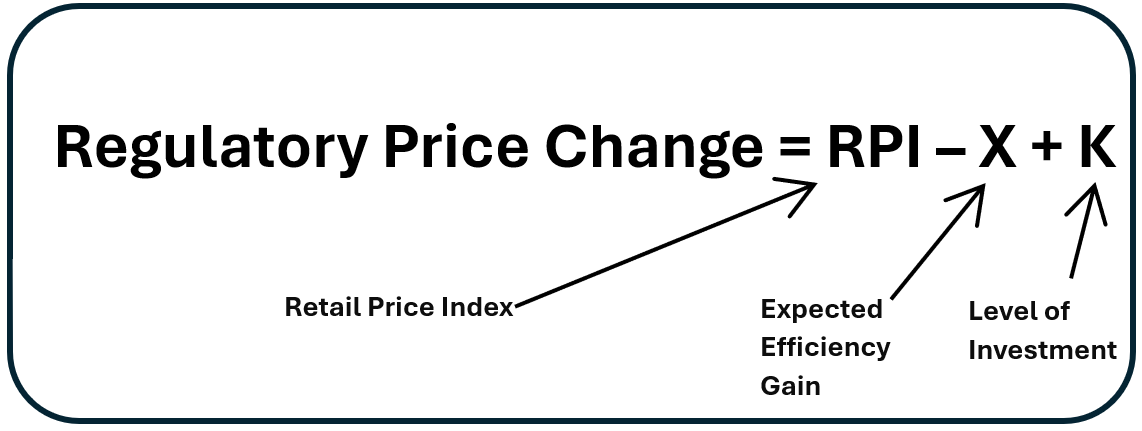

Regulators are able to control prices making monopolistic firms below the profit maximising threshold, using the RPI-X formula, as shown below:

This formula for the regulatory price change is most commonly used in the airline industry.

Regulators are also able to use another system of the RPI-X+K formula, which has been argued to be more effective than the RPI-X formula, as shown below:

This formula for the regulatory price change is most commonly used in the water industry.

The second formula gives an incentive for firms to be as productively efficient as possible, as if costs fall below X, it results in increased profit. However, it is difficult for regulators to measure X due to asymmetric information. This means that there could be sudden price cuts in products, such as the 10% cut in water in 2000.

Performance targets

Performance targets refers to the specific objectives that regulators are looking for firms to achieve, by using certain aspects of goods and services, or production processes of other firms. For example, regulators have the option to implement yardstick competition, where regulators compare the performance of different entities within an industry to incentivise improvement. This has included setting up punctuality benchmarks for train operating companies, based on the top-performing European counterparts. Another approach relating to performance targets has been used in the water industry, which involves segmenting a service into regional sectors, thus encouraging comparison between different regions. These measures incentivise firms to enhance their service standards, which ultimately benefits consumers, in monopolistic markets. However, it is likely that firms may resist target implementation, meeting these targets without genuine improvement.

Promoting competition and contestability

Competitive tendering

Public goods which are provided by the government, may not always be specifically produced by the government itself. For example, lots of the healthcare equipment used by the NHS is not directly produced by the NHS, but is purchased by the private sector. An example can also be used in services through Private Finance Initiatives (PFIs) which is when the government contracts private firms to run state provided operations. This can encourage competition into the market if the government looks to request competitive tenders by using a checklist to offer a private firm a contract, with the firm offering the lowest price being offered the contract. This is also beneficial to the government as it can reduce costs, thus saving money for expenditure in other state-run industries. However, this process is usually quite time consuming and can create an opportunity cost for time being used elsewhere.

Deregulation

Deregulation is the process by which rules are removed, or loosened from a market. By using deregulation, it can remove regulatory barriers to entry. In turn, this may increase competition, as it is easier for firms to enter the market.

Deregulation is used when there is excessive regulations in a market, also known as "red tape" or bureaucracy". An example of deregulation being used to foster competition, was the 1978 Airline Deregulation Act in the United States, which removed the Federal Government's control over things such as routes and regulatory barriers to entry. This deregulation allowed for new firms to enter the market, thus competition increased.

Privatisation

Privatisation is the process by which state owned assets are sold, and purchased by the private sector. A good example of this was the British Telecommunications Act which was passed in 1984, which allowed for the majority of British Telecom shares to be sold to the private sector. BT shares were listed on the London Stock Exchange, where 50.2% of it shares were bought by the private sector.

Economists who believe in a free market approach to the economy, believe that when firms are owned by the private sector, resources are allocated more efficiently because private sector firms are driven by the incentive of profit. This increase of allocative efficiency is likely to be paired with an increased quality of the products sold. Additionally, in the case of BT, once it was privatised, the once monopolistic telecom market, became a more competitive market, as privatisation was paired with deregulation.

Additionally, the sale of these assets to the private sector raises revenue for the government. However, this is only a one-off payment, so it may only be significant in the short-term.

Protecting suppliers and workers

Reducing the power of monopsonies

For many suppliers who operate in the primary sector, it is likely that they are exploited by the monopsony power of entities such as fast-food chains, supermarkets and restaurants. For example, many farmers have lost out to supermarkets in price wars, due to the fact that supermarkets keep on negotiating lower prices from alternative farmers, to lower their own prices and maximise profit and competition. However, this is disadvantageous to the farmers, because in some circumstances, they are unable to even make a normal profit, leading them to closure and leaving the market. The government is able to regulate this, so that suppliers are able to receive a fair exchange for their goods and services. For example, the government can use subsidies to support their production. Additionally, the Competition and Markets Authority (CMA) may investigate entities such as supermarkets, to ensure they are not abusing their monopsony power.

Nationalisation

Nationalisation is the process by which private sector assets are sold to the public sector, and control is no longer within the private sector e.g. the UK railways in 1948, coal mining in 1947, and the steel industry in 1947. Nationalisation creates natural monopolies, which can be advantageous for certain aspects of resource allocation, such as water provision. Conversely, nationalised industries aim to achieve alternate objectives compared to the privatised industries, in that increasing social welfare in a nationalised industry is more important than profit maximisation, which is the most desired objective in privatised industries.

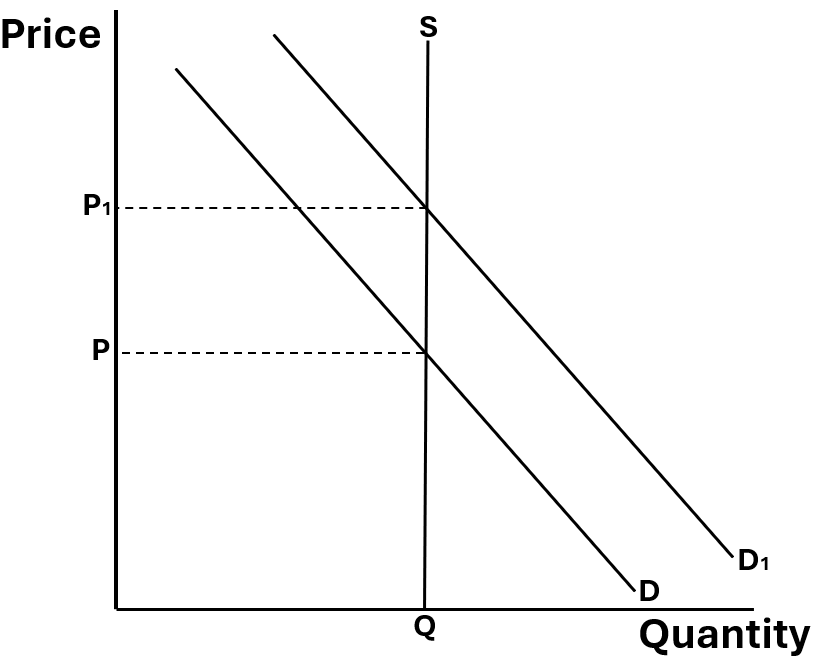

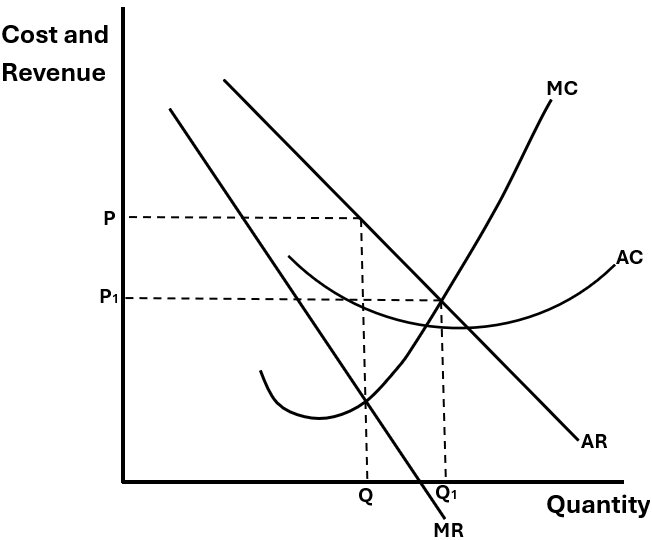

Diagram for nationalisation and privatisation

It is likely for privatised firms to be operating at PQ, with nationalised firms at P1Q1.

Impacts of government intervention

Lowering prices

- Reducing monopolistic power: The government may reduce the power of monopolies using intervention, and in the process may prevent monopolies from charging excessive prices.

- Regulation: The government may regulate industries to limit excessive pricing practices. In turn this can lead to reduced prices in certain industries.

- Subsidies: Subsidies used to protect suppliers when monopsonies are found exploiting them may lower the cost of production for firms. This is likely to be passed onto the consumer through lower prices.

Increasing prices

Tax: Taxes such as corporation tax can lead to higher costs of production, which in turn fall negatively onto consumers in the form of higher prices.

Monopoly regulation: Government attempts to regulate monopolies, in some circumstances, can lead to regulatory capture, which ultimately leads to higher prices falling on consumers.

Profit

If the government uses intervention in the form of price caps, it may limit the amount of profit produced by firms. This can also negatively affect the economy if investment is reduced, as investment is a component of Aggregate Demand (AD).

Quality

Due to the nature of government intervention allowing the government to set performance targets, it may lead to increased quality of products by producers. Additionally, it is likely that firms in the private sector are already producing high quality products, in order to gain an edge in market share, due to non-price competition.

Choice

If the government use intervention, such as deregulation, to reduce barriers to entry, and allow more firms to enter the market, it is likely that consumers will have a wider range of products to choose from. However, if the government use price ceilings, and price floors, it is likely that firms may not be able to survive in the market, thus giving consumers less choice when shopping for their desired products.

Government intervention limitation

Regulatory capture

Regulatory capture occurs when regulators start acting in consideration of the interests that firms they are regulating hold. This is a limitation to government intervention, because regulatory bodies may be regulating with the intent to help the firms they are supposed to be regulating, and not taking other economic agents, such as the consumers into account.

Asymmetric information

Asymmetric information may make it difficult for the government to know where to set regulation. Therefore, it is possible for them to set regulation that is disadvantageous to every economic agent e.g. setting a minimum price to high, or a maximum price too low etc.

Government failure

Government failure occurs when government intervention leads to a net welfare loss and an inefficient allocation of resources in an economy. This net welfare loss occurs when the social cost arising from the initial intervention are greater than the social benefit arising from it. There are four potential causes of government failure: A Distortion in Price Signals, Information Gaps, Unintended Consequences and Administration Costs.

A distortion in price signals

Usually, the price signals in an economy are set by the free market mechanism, or the invisible hand. However, some types of government intervention may distort this mechanism, such as subsidies and taxes. For example, many farmers in the EU are heavily subsidised, as they are unable to produce goods at a competitive price, meaning that the government are the force that keeps them in business, thus distorting the price mechanism.

Information gaps

The decisions that governments make are usually based on previous data, that allows them to make a prediction about the future, thus allowing them to direct spending in the appropriate sectors. However, due to infinite external factors, it is usually impossible for the government to correctly predict any forecasts for the future. This means that the government may invest in sectors where the social costs outweigh the private costs thus leading to negative externalities, or general market failure, as a result of information gaps in the government.

Unintended consequences

Some methods of intervention used by the government to achieve objectives in a certain sector may distort success in other sectors, or other economic agents. For example, setting a minimum wage may be beneficial to certain workers, however, it may create unintended harms on producers, who simply can not afford to pay their labour at this cost, driving them out of business.

Excessive administration costs

In many public sector industries, the money used for expenditure is mostly used on administration costs. This means that the social costs could be higher than the social benefits, if money is not allocated as it would be expected to be in the correct places. For example, lots of money spent in the NHS is spent on organisation and admin costs, rather than the health care itself, leading to potential government failure.