Business growth and objectives

Business growth

Types of firms

Reasons why firms grow

Economies of scale: If a firm grows it will be able to gain cost advantages when it increases the scale of its production i.e. economies of scale. This is advantageous because it means that they may be able to make more supernormal profits if their long-run average costs can fall. Profit maximisation is the main goal for most firms which can be achieved through adopting as many economies of scale as possible.

Monopoly power: If a firm gains monopoly power (25% or more market share), it will have significant influence over the market price. This is because it will be able to substantially restrict or extend market supply thus allowing it to control the price of the product it is selling. If it can do this, it can restrict supply and will then be able to earn supernormal profits by charging high prices for its products.

Diversification: A firm may grow into other markets, which will spread risk among its operations. This means that if a market is struggling, or collapses, the firm has alternative markets to venture into, allowing it to retain long-term supernormal profits.

Reasons why firms remain small

Niche markets: Some firms are in niche markets, and attract customers by being personal or small. By growing, they may lose their personal factor and can lose customers. Therefore, they may benefit more by remaining small.

Limited economies of scale: Some firms may find it difficult to gain any more economies of scale due to many reasons such as resource limitation or regulation. Therefore, they may choose to remain small because the advantage gained from achieving more economies of scale does not outweigh the costs in the process of attaining them.

Easier to retain control: Owners of firms may prefer complete control over their operations. Therefore, by staying small there is not an overflow of responsibilities for the owner to cover. Additionally, if the owner retains control, it can reduce the principal agent problem.

The principal-agent problem

Within a firm, there are owners and workers, both of which strive for different goals. The owner is likely to seek profit maximisation, whereas workers may seek sales maximisation (especially if they get paid per sale). This means that the principal and agent strive for different objectives in the firm, showing the principal-agent problem. In larger firms, there is likely to be a divorce between ownership and control, which means the owners may not have a part in the day-to-day running of the firm, thus meaning the firm is driven by the objective of the agent. However, in smaller firms, the owner is likely to be running the firm, leading the firm in the direction of the principal's objectives.

The solution to the principal-agent problem

The principal-agent problem can be solved if the objectives of the owners and the workers are the same, thus creating a marriage between the ownership and control of the firm. An example of how this can be executed is if the workers became minority shareholders, and the workers were incentivised by dividends, which will be higher if the firm's profit margin is higher. This aligns both the principal and the agent's objectives to be one of profit maximisation and hence solves the problem.

Private and public sector firms

Private

Ownership: Owned by private individuals or shareholders, with the control within the firm typically held by investors or founders.

Objective: Normally, the objectives of privately owned firms are profit maximisation and increasing shareholder value; however, this can vary from firm to firm.

Funding: Funded through private capital from selling shares or loans from commercial banks.

Examples: Apple, Amazon, Tesco, local businesses etc.

Public

Ownership: Owned and operated by the government or state on behalf of the general public.

Objective: Public-owned companies often aim to maximise social welfare for economic agents, instead of profit.

Funding: Funded by tax revenue received by the HM Treasury, allocated in government budgets.

Examples: NHS, public transport systems, state schools etc.

Charities and not-for-profit organisations

Charities and not-for-profit organisations aim to address social issues and provide services without the goal of making a profit. The charities rely on fundraising, grants and donations to achieve their goals, and will only use the profit made to cover costs of providing the services.

Types of business growth

Organic growth

Organic growth occurs when a firm grows naturally from within. This is not reliant on external acquisitions or mergers, and the resources used are entirely their own.

Advantages of organic growth

Maintained control: The business grows using its resources, avoiding the complexities of merging with a different firm and using its resources.

Easier than external: Existing management and organisational structures will remain intact, thus making business strategies easier to implement.

Cheaper than external: External growth strategies can come at large costs, especially because of all the admin costs involved in combining all of the operations. These costs are negligible in organic growth.

Disadvantages of organic growth

Limit in expertise: Organic growth may lack access to new ideas and technologies found when merging or acquiring other firms.

Takes longer than external: Growth is gradual, which could mean that firms miss out on fast market opportunities, whereas external growth can grow much faster at almost instantaneous rates after the merger or acquisition is complete.

Restricted growth: Organic growth is restricted by the company's current market and resource base, which can be increased by using external strategies instead.

Forward vertical integration

Forward vertical integration occurs when a company merges with or acquires another firm which is closer to the consumer by increasing operations later in the supply chain. For example, if a beverage producer were to produce its own chain of cafes.

Advantages of forward vertical integration

More market control: The firm may have more ability to influence prices and distribution directly closer to the consumers, thus increasing potential profitability and efficiency.

Guarantees a market: Ensures a steady demand closer to the consumers, by controlling retail or distribution channels.

Creates barriers to competitors: Makes it harder for alternative producers to expand or grow into the same market, since they have restricted access to distribution channels.

Disadvantages of forward vertical integration

Managerial diseconomies of scale: Increased complexity can reduce efficiency at higher levels of management, leading to an increase in long-run average costs and reducing profitability.

Lack of expertise in the forward market: Businesses may struggle to manage distribution and retail effectively if they have come from earlier in the supply chain, and have a lack of experience in selling and allocating their resources.

Higher operating costs: Costs of running additional segments of the new chain may outweigh the benefits of using this new chain.

Backward vertical integration

Backward vertical integration occurs when a company expands its operations to include earlier stages of the production process, such as merging with or acquiring a new raw material source.

Advantages of backward vertical integration

Guarantees supply: Ensures consistent access to necessary raw materials or components thus increasing business confidence, and being able to forecast future performance more accurately.

Reduces costs: Eliminates markup costs from external suppliers, which can reduce the cost of production thus increasing profitability.

Enhanced quality: Greater control over the quality of inputs into the retail and distribution channels, thus increasing the quality of the goods being sold.

Disadvantages of backward vertical integration

Drop in share price: Investors may perceive backward integration as risky or non-profitable, thus leading to a drop in the share price.

Lack of innovation: Focus on controlling the inputs into the firm may stifle creativity, for the operations in the later stages of the supply chain.

Lack of synergy: Integration may not align well with existing operations, which may reduce efficiency within the two firms.

Horizontal integration

Horizontal growth occurs when a company expands its operations by acquiring or merging with another firm in the same stage of the production process, in the same market.

Advantages of horizontal integration

Less competition: Directly reduces the amount of rivals in an industry, thus increasing market share for the new firm and strengthening the market position they are in.

Higher market share: Combines the share of revenue that the two firms earn thus directly increasing market share.

Economies of scale: The new firm may experience cost reductions by increasing the scale of production using the resources of both firms.

Disadvantages of horizontal integration

Loss of key workers: Employees from the acquired firm may leave, since they do not want to work for the other firm, taking valuable expertise and knowledge which could help the new firm grow.

Attracts the attention of the CMA: Horizontal integration increases market share, which could be against the interest of the consumer by restricting choice and manipulating the price. This could force the CMA to intervene and stop the merger completely if deemed anti-competitive.

Increased risk: Overreliance on a singular industry or product line can lead to increased vulnerability if the supply chain is disrupted, or the market faces changes in demand.

Conglomerate integration

Conglomerate integration occurs when a company diversifies into other markets, by acquiring or merging with another firm in a completely different market.

Advantages of conglomerate integration

Diversification: Reduces vulnerability from volatile supply and demand chains by expanding into a completely different market.

Asset stripping: Selling undervalued, underperforming segments in other companies in other sectors can raise capital for the acquiring firm for core business activities.

Room for growth in other markets: Opens up new opportunities for expansion if there is market share to be competed for in other markets.

Disadvantages of conglomerate integration

Lack of specialist knowledge: Management workers may struggle to operate efficiently in other markets that they have had a lack of experience in, or are unfamiliar with.

Asset stripping only benefits producer: Asset stripping may harm employees of the stripped businesses, and does not act in the interest of the consumer.

Different corporate cultures: Merging vastly different work environments can create conflicts in the new firm, thus making it operate inefficiently.

Constraints on business growth

Size of market: In niche markets, there may be a lack of consumers that purchase in this market. This can constrain business growth since there are only a maximum amount of consumers to compete for, and expanding factors of production will just be a waste of money.

Owner objectives: Some owners may prioritise other sectors of business more important than growing it. For example, they may prioritise stability in the firm or lifestyle goals, rather than aggressive and risky business growth.

Regulation: Legal requirements may restrict certain activities in a market that can help a firm grow. This can constrain overall business growth.

Access to finance: Limited capital, as a result of poor access to finance can reduce business growth since they will not have the resources to purchase any more factors of production or raw materials. This can act as a constraint on growth in the short term until their access to capital improves.

Demergers

A demerger is a process by which a company separates one or more of its businesses into independent entities. The separated entities can operate as businesses themselves, either being privately owned or listed publically.

Reasons for demergers

Lack of synergy: The combined business units may not work well together, which reduces overall efficiency. This may make it more advantageous to split the firms apart.

Value of the firm: Splitting firms into multiple entities can increase shareholder value for all of the firms since the businesses become more focused and thus become more attractive to investors.

More focus on core activities: Allows each unit to concentrate on its primary goals and use their expertise to their advantage.

Consequences of demergers

Consumers

Higher prices: Reducing the scale of production in all the firms can reduce the amount of economies of scale that the demerged firms gain. This can increase the cost of production which may be passed onto the consumer in the form of higher prices.

Higher quality: Specialised focus on the products that the demerged firms are producing can lead to an increase in quality for those products.

Less choice: Fewer combined offerings by the demerged firms may lead to a limitation in consumer options.

Producers

Higher efficiency: Streamlining operations through demergers can reduce diseconomies of scale, which leads to increased efficiency in the firm.

Ability to survive: Smaller, focused businesses are more agile and resilient to changing market conditions, which may increase the ability of the demerged firm to survive.

Higher profit: Greater specialisation can lead to increased efficiency which can lead to greater profitability in the long-run.

Workers

Chances for promotion: If a demerger occurs, there is likely to be less competition for the same roles, because many workers will leave for the other firm. Additionally, managerial positions may open up, leaving established workers a higher chance of being promoted.

Higher wages: The producer may be experiencing higher levels of profit, which they may choose to invest in labour wages, giving the workers a larger reward for their services.

Increased job security: A more profitable firm allows workers to be more secure, as they have generated many resources to help them survive in the market.

Business objectives

Profit maximisation

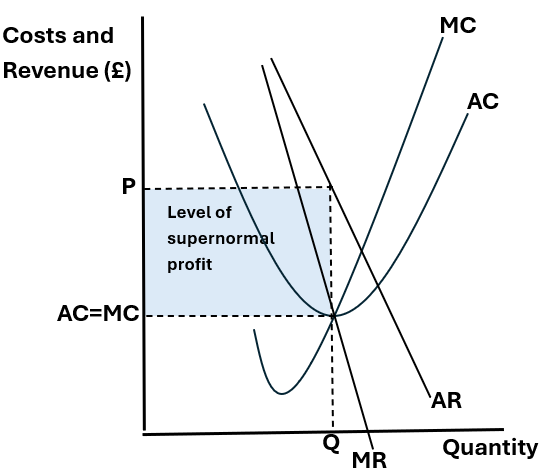

Profit maximisation occurs when a firm's total profit is at its highest point, achieved at the point where Marginal Cost (MC)=Marginal Revenue (MC). The diagram below shows a firm in imperfect competition that is profit maximising.

Revenue maximisation

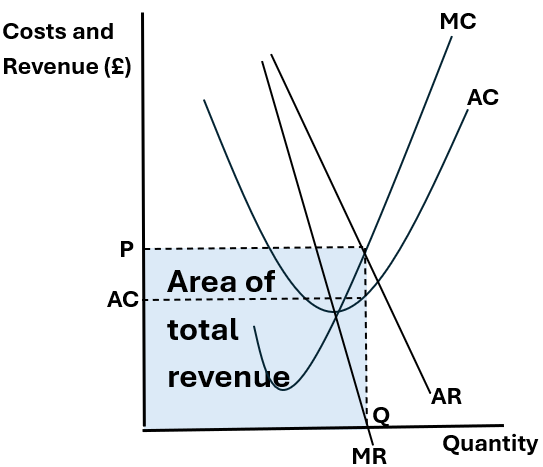

Revenue maximisation occurs when the firm produces at the quantity where marginal revenue is equal to zero. This ensures that revenue is at its peak.

Sales maximisation

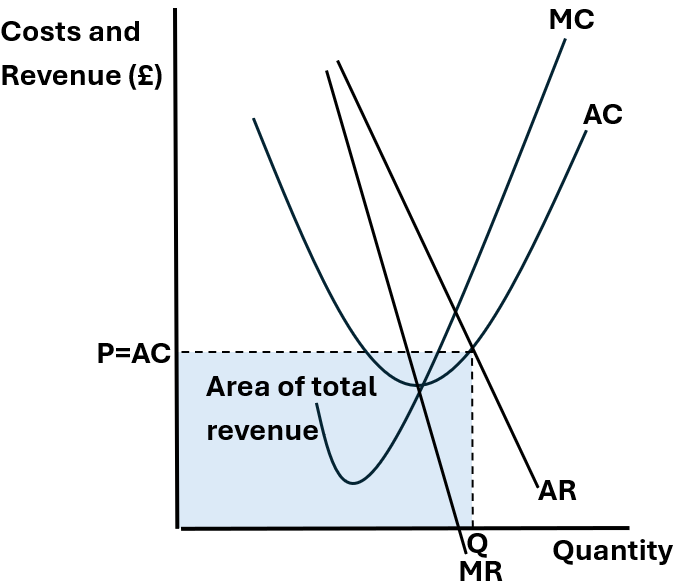

Sales maximisation occurs at the highest level of quantity produced without making a loss. This is at the point where Average Cost (AC)=Average Revenue (AR). This is shown below:

Satisficing

Satisficing is a business strategy where firms pursue an acceptable or satisfactory outcome in their operations. This approach often involves balancing multiple business objectives, such as profit, growth and revenue.