National income and economic growth

National income

The circular flow of income

The circular flow of income is an economic model that demonstrates how money moves within an economy, and shows the interrelationships between the major economic agents of an economy, including showing income flows between firms, households and the government. This model demonstrates how income is generated from the output of goods and services, and how that income is saved or spent in different sectors. In the basic circular flow model (two-sector model), the money flows continuously in a circular fashion, with households providing factors of production and receiving income as a reward, then spending this reward, and then firms provide output and receive income from household expenditure. However, this model is way too simplistic, and injections and leakages can occur in the circular flow which change the amount of money flowing.

Injections

Investment (I): Investment includes business expenditure, capital goods, and new projects, which adds to economic activity thus injecting money into the circular flow of income.

Government expenditure (G): Government spending on public services such as healthcare and infrastructure injects money into the circular flow of income, since this money can be used to pay households who work in the public sector, which increases the quantity of money in flow.

Exports (X): Increased export expenditure from foreign countries can inject money into the circular flow of income, since foreign money is now flowing into the domestic economy.

Leakages

Taxation (T): An increase in taxation will act as a leakage from the circular flow, since income is being taken by the government, thus reducing the money supply in flow.

Saving (S): High amounts of saving can act as a leakage from the circular flow, since households are no longer contributing income earned back to firms in the form of expenditure. This reduces the amount of money flowing in the circular flow of income.

Imports (M): Imports act as a leakage from the circular flow of income as the expenditure by households is now received as income by another country. This injects income into a foreign circular flow but leaks from the domestic economy.

Income and wealth

Income

Income is defined as the reward earned for providing a service by a factor of production. Income is often known as a flow of assets. For example, the reward earned by each factor of production is as follows:

Land: Rent

Labour: Wages

Capital: Interest and dividends

Enterprise: Profit

Wealth

Wealth is defined as the market value of all assets owned by an entity in a given time period. Wealth is often known as a stock of assets, and examples can include savings, property and commodities.

The multiplier

The multiplier effect and ratio

The multiplier is a concept in economics that an initial injection of income into the circular flow of income can lead to a larger effect on the circular flow of income. For example, an initial injection of £500mn by the government may be able to lead to a change in GDP of £1bn, since one person's spending is another's income. This can also work in reverse as a negative multiplier effect, where an initial leakage can lead to an increased detrimental effect on GDP.

The multiplier ratio is calculated by the ratio of the final change in income: to the initial injection/leakage from the circular flow of income.

The effect on the economy

The effect on the economy of the multiplier, is that economic growth can grow or decrease much quicker than anticipated, after an initial injection or leakage. The size of the effect depends on the marginal propensities to consume, tax, import and save (MPC, MPT, MPM and MPS). The marginal propensity of an action is defined as the proportion of extra income which is spent on that action. For example, the MPC value of a consumer is calculated by dividing the extra income spent on consumption by the total extra income earned.

For a larger effect of the multiplier, the MPC value must be high, and the MPT, MPM and MPS values must be minimal. This reduces the amount of leakages from the economy, and ensures that lots of money is flowing through the economy due to high consumption.

The effect on AD

The multiplier effect will lead to a larger increase in AD, after an initial increase, which will lead to a larger increase in real output. However, this can only occur if there is sufficient capacity in the economy, and this occurs when the economy is not operating at full employment of its factors of production. Using classical theory, the economy is always in full employment in the long-run, thus an increase in AD and the multiplied effect will only ever lead to a fully inflationary effect.

Economic growth

Economic growth can be defined as a growth in real GDP over time, meaning it occurs when the monetary value of the level of output being produced is greater than the rate of inflation.

Causes of economic growth

Efficiency: Increased efficiency leads to increased economic growth, since less resources are then needed to produce more goods.

Technological advantages: Improved technology leads to increased efficiency, and lowers the average cost of production. This means that more output is able to be produced at a lower cost, thus achieving economic growth.

Land: When countries find new resources in their country, such as finding new oil, it can contribute to increased output, and thus economic growth.

Labour: An increase in the size or productivity of the workforce can lead to increased output in an economy. This can lead to economic growth.

Capital: If a country receives capital from Foreign Direct Investment (FDI), they can use this capital to enhance their technological capabilities. This can increase the amount of output produced per input thus allowing for economic growth to flourish.

Enterprise: By incentivising individuals to start businesses, it can foster economic growth in an economy. This is because the creation of new businesses increase output and can create jobs.

Output gaps

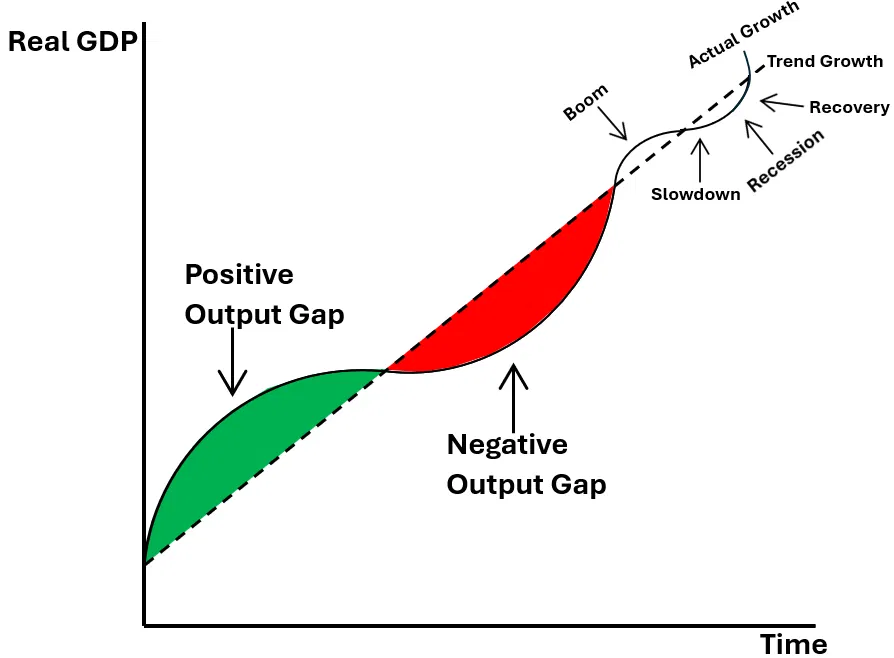

The trade cycle

Boom

Booms are positive periods in economies, highlighted by high levels of employment and economic growth. In a boom, the economy is likely to be working in a positive output gap, above the PPF of an economy. However, it is likely in a boom to be inflationary pressure, as a result of demand-pull inflation.

Recession

Recessions occur during economic downturns, and is normally characterised in the UK by two consecutive quarters (6 months) of negative economic growth. Recessions usually occur in a negative output gap, when factors of production are not being fully employed to produce maximum output. Furthermore, recessions are likely to reduce inflationary pressure and can even end up into deflation.

Advantages and disadvantages of economic growth

Advantages for consumers

Higher living standards: Economic growth typically leads to job creation and increased output. This can lead to increased quality of goods for consumers, thus heightening the living standards of consumers. Additionally, this job creation can increase real incomes for worker consumers, thus allowing them to spend more to increase their living standards.

Improved public services: In periods of higher economic growth, governments will be receiving lots of tax revenue, allowing them to spend in large quantities on the economy. This can lead to an increase in the quality of public services.

Increased choice: Economic growth can foster innovation, thus giving consumers a wider range of goods and services to choose from. This increases consumer welfare as a result of greater choice.

Disadvantages for consumers

Income inequality: Economic growth may not be evenly distributed between all groups of consumers. This can leave different groups of consumers reaping the benefits of economic growth unevenly.

Inflationary pressures: Economic growth can lead to demand-pull inflation as a result of too much demand in the economy. This raises the price level in the economy and erodes the purchasing power of money for consumers.

Environmental degradation: Increased economic activity can lead to increased pollution due to the increasing amount of output being produced. This can lead to negative externalities on consumers, such as health-related consequences.

Advantages for producers

Increased sales: Economic growth leads to higher real income for consumers. This means that consumers will have more money to spend on the products of firms, leading to more sales for producers.

Access to a larger market: Growth can often expand international and domestic markets, allowing for producers to reach a wider audience of people with their products.

Increase in business confidence: Economic growth provides a more positive forecast of the future for a business. This may increase business confidence which could lead to increased risk-taking and thus more organic growth if the risk taking is successful.

Disadvantages for producers

Increased competition: Increased growth can foster risk taking amongst firms who look to expand into other sectors, or wish to join new markets. This can increase competition amongst firms which reduces market share for incumbent producers.

Higher costs: Rapid growth can lead to the overuse of natural resources, thus causing cost-push inflation for many resources. This may increase the cost of production for firms.

Volatility: Economic growth cycles can lead to boom and bust periods in an economy. This can reduce the ability for firms to maintain stable operations and forecast effectively for the future.

Advantages for governments

Higher tax revenue: Increased profits for firms and higher incomes from workers can lead to an increase in corporate and income tax revenue. This gives governments more resources to invest into the economy.

Increased political stability: During periods of high economic growth, the government are likely to be popular among the population, thus meaning that they are unlikely to be voted out or be under large quantities of scrutiny. This can make the process of running a country much smoother.

Improved balanced budget: Higher tax revenues during times of high economic growth can allow governments to achieve the macroeconomic objective of a balanced budget much better.

Disadvantages for governments

Inflationary pressures: Inflationary pressures can reduce the real value of tax revenue. This means that the government have less resources to spend on economies in real terms.

Resource misallocation: Excessive growth in certain sectors can lead to the government allocating resources to them. However, some sectors may be short-term bubbles, thus the government investment is not effective in the long-term.

Advantages for society

Reduced unemployment and poverty: Growth typically fosters job creation, which means that unemployment in society is less likely to occur on a larger scale. Furthermore, with more people earning stable incomes, it is likely that poverty will be reduced.

Social welfare improvements: With greater tax revenue received by the government, they are able to improve the quality of social welfare safety nets which can have a beneficial effect on society.

Disadvantages for society

Environmental harm: Increased growth can lead to increased pollution related to the production process, and can lead to increased environmental degradation. This is harmful for society since it reduces the quality of life.

Cultural change: Rapid economic growth in areas can lead to the increased migration of people. This can erode the cultural differences between areas that make them unique.

Social fragmentation: Economic growth can cause income and wealth inequality. This creates social tension between different groups of individuals in society who strive for different goals.