Measuring economic performance

Measuring economic performance

Economic growth

Economic growth is defined as the sustained growth in real GDP over time. Economic growth can bring many positive consequences to the living standards of the population, hence why it is a very important macroeconomic objective to achieve

GDP: The total monetary value of all final goods and services produced in an economy, within a certain time period.

Total GDP: This is the total aggregate value of all final goods and services produced in an economy, within a certain time period.

Real GDP: Real GDP is a measure that adjusts nominal GDP for the rate of inflation, providing a more accurate representation of how the economy has performed in certain economic climates.

GDP per Capita: The average economic output per person, found by dividing GDP by population size.

Other measures of national income

Gross national income (GNI): GNI is a measure of the income earned by workers and companies both domestically and abroad.

Gross national product (GNP): GNP is the total value of all goods and services produced in an economy, excluding output produced by foreign entities within a country.

Comparing growth between countries

Growth in a country's national income statistics is likely to indicate a rise in living standards for its population. This data can then be compared to other countries to see if it has done well, relative to other nations.

Purchasing power parities

Purchasing power parities adjusts exchange rates to reflect the relative purchasing power between different currencies. This is important as it enables a more accurate comparison between different countries who use different currencies.

Disadvantages of using GDP to compare living standards

Quality of data: Many countries use lots of resources to gather economic data, however, it is likely that LEDCs spend less money on gathering economic data. This can result in a large distribution on the quality of data found between countries, thus resulting in an unfair or inaccurate economic comparison.

Size of the informal economy: Since the informal economy is not registered, it is not measured as output in terms of calculating GDP. This means that countries with large informal economies may not be fairly compared between countries with smaller informal economies.

Population size: GDP is not a good measure when comparing smaller populated countries to large population countries. This is because the larger countries have more people to produce output, however, this problem can be solved by using GDP per capita instead of GDP.

Defence spending: GDP includes defence spending, which may be a lot for large countries. However, defence spending does not necessarily contribute for living standards, making GDP a poor measure of living standards.

Negative externalities: GDP does not include negative externalities, which can reduce the living standards of citizens.

National happiness in the UK

Using GDP can measure income and relative living standards, but it can not measure happiness. Happiness is based on other factors such as health and freedom. In the UK, David Cameron launched the "Measuring National Wellbeing" project which is a better measure of relative happiness. This quarterly project asks around 320,000 random citizens across the UK four questions relating to life satisfaction, worthwhile activities, happiness, and anxiety. According to the survey, people living in London have the lowest well-being, and people living in Northern Ireland have the greatest well-being. This is despite London having a much higher average income.

Real income and subjective happiness

Subjective happiness is an individual's self-assessment of their well-being, happiness, and life satisfaction. A key argument in the relationship between real income and subjective happiness is that they are positively related. However, the "Easterlin Paradox" debates this, in that higher levels of income do not necessarily result in more happiness. This paradox suggests that after national income increases to cover everyone's basic needs, an increase in consumption will not increase long-term happiness.

Inflation

Inflation: Inflation is the rate at which the general price level for goods and services increases at over time, leading to a decrease in the purchasing power of money.

Deflation: Deflation refers to when the rate at which the general price level of goods and services changes is negative. This is often associated with low consumer demand and economic stagnation.

Disinflation: Disinflation refers to the situation when the rate of change in the general price level of goods and services is positive, but the positive value is lower than the last positive value recorded.

Measurements of inflation

Consumer Price Index (CPI)

CPI is used to measure inflation in the UK. CPI uses a basket of household goods and measures the increase in the price level for these goods over time. It then takes an average of the increase in the price level of all these goods, for the rate of inflation. The basket of goods include commonly purchased goods by consumers.

Limitations of CPI

Not representative: The CPI can not be used to measure changes in the rate of inflation between areas, only for changes from time to time.

House prices: CPI does not take house prices or mortgage interest payments into account, which have risen massively in recent times and make up a large proportion of consumer expenditure. This makes CPI less representative.

Retail Price Index (RPI)

The retail price index is a broader measure of inflation, since it includes house prices and mortgage interest rates. However, is not typically used in the UK to define the current inflation rate.

Causes of inflation

Demand-pull

Demand-pull inflation occurs when aggregate demand outpaces aggregate supply. This leads to an increase in the price level, due to excess demand being rationed out in the economy.

Cost-push

Cost-push inflation occurs when an increase the price in raw materials lead to an increase in the cost of production for firms. This leads to the cost passing onto the consumer and the general price level rising.

Changes in the money supply

An increase in the money supply can lead to inflation. This is because the purchasing power of money is reduced if more money is in the system. This is derived from the concept of "too much money chasing few too goods".

Consequences of inflation

Consumers

Negative income effect (psychological): An increase in the rate of inflation can lead to a reduction in real incomes. This can reduce the amount of money that a consumer has to spend in their mind, thus leading to reduced consumption.

Less to spend: An increase in the rate of inflation erodes the value of real money. This means in real terms, consumers have less to spend.

Cheaper debt: Since an increase in the rate of inflation erodes the real value of money, it also erodes the value of debt, allowing consumers to borrow cheaper in real terms.

Producers

Reduced international competitiveness: An increase in the domestic rate of inflation would lead to more expensive exports for other countries to purchase. This leads to a reduction in export price competitiveness.

Menu costs: If the rate of inflation is constantly changing the prices of goods, producers have to constantly amend prices, which is an administration cost.

Difficult to forecast: Since inflation can be unpredictable, producers may be unable to forecast their future performance. This could lead to a reduction in animal spirits.

Government

Cheaper debt: Since an increase in the rate of inflation erodes the real value of money, it also erodes the value of debt, allowing the government to borrow cheaper in real terms.

Reduced real tax revenue: An erosion of the value of money also reduces the amount of tax revenue received by the government in real terms.

Workers

Job losses: Inflation can erode the real supernormal profits of firms, and if firms feel that they need to cut costs to retain the lost value of supernormal profits, they may look at shedding labour. This leads to workers losing their jobs.

Reduced real income: The value of the real income earned by workers will decrease when the rate of inflation rises.

Unemployment

Unemployment: Occurs when a person is willing and able to work, but is currently not in a job.

Economically inactive: Workers who do not participate to the labour force, so those that are not actively employed but are also not seeking work.

Underemployment: Underemployment refers to when workers are not working to their full capacity. This can include working part-time, or working in jobs that do not fully harness their skillset.

Measuring unemployment

Claimant count

The claimant count is a measure of unemployment which aims to count the number of people who are claiming unemployment-related benefits. However, it has some drawbacks, in that not every unemployed person chooses to claim benefits, leading to an inaccurate figure.

ILO measure

The ILO measure defines an unemployed person as someone who is not working, is available to work, and has actively sought work in the past four weeks. This measure is used internationally to allow countries to compare their unemployment rates. However, this is only an estimate and is based of a sample given to random households.

Types of unemployment

Frictional unemployment

This is unemployment caused by time lags when workers move between jobs. An example of this is when teachers leave a school at the end of the academic year, to join another school. But during the time lag when the teacher is moving schools, they are known as frictionally unemployed.

Seasonal unemployment

This is unemployment that is caused when seasons change, and the job is no longer needed. For example, ski instructors during the summer, when the ski season is over.

Cyclical unemployment

Cyclical unemployment is caused when there is a lack of demand in the economy. This means that labour is no longer demanded since goods and services are in low demand, leading to unemployment.

Structural unemployment

Structural unemployment is caused by the permanent decline of an industry, which results in workers being unemployed because their skillset is no longer of use in that country. For example, many workers are structurally unemployed in Sheffield and Stoke-on-Trent, after the permanent decline of their steel and pottery industries.

Voluntary unemployment

Voluntary unemployment occurs when an individual is willing and able to work, but is choosing not to work in a given time period. This can occur from a variety of scenarios e.g. personal preference or waiting for a better job.

Real wage inflexibility

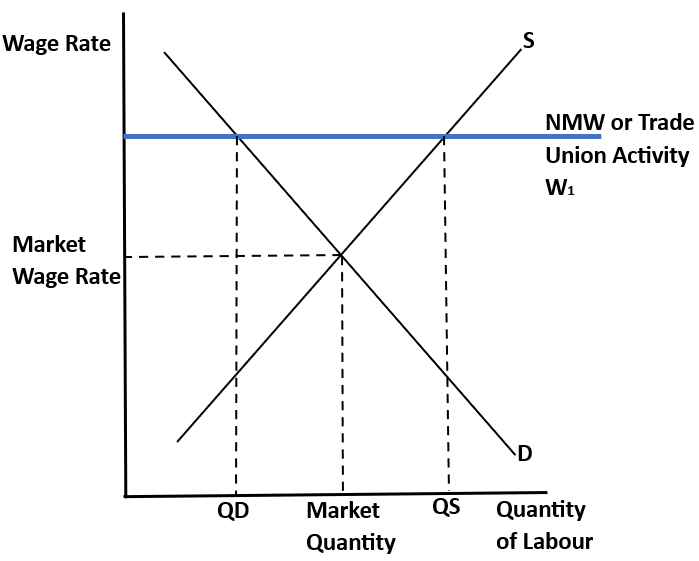

Real wage inflexibility occurs when a minimum wage is set above the market equilibrium for wage rates. For example, if a National Minimum Wage (NMW), or if trade union activity forces wages to be at W1, or anywhere above the market wage rate. This means that unemployment occurs from QD->QS, since the quantity of supplied labour exceeds the quantity demanded of labour at the new wage rate (W1).

The significance of migration and skills for employment

Consequences of unemployment

Consumers

Less choice: If unemployment increases, less goods and services are being produced. With reduced output, comes reduced choice for consumers.

Less to spend: For consumer workers, if they become unemployed, they will have less income and thus have less to spend as consumers.

Lower prices: If unemployment increases, it may lead to a reduction in consumption. This reduction in consumption can lead to reduced aggregate demand which in turn pushes down the price level in an economy.

Producers

Fall in profit: Unemployment could lead to reduced consumer spending since workers are losing their incomes. This could lead to reduced sales and potentially reduce profits.

Less skilled workers: In the long-term, if many workers are left unemployed, when they return to the workforce, they may be subject to a skills gap. This can lead to less skilled workers in the workforce.

Lower labour costs: In a high-unemployment environment, the supply of labour increases. this leads to a reduction in the market wage rate for workers. This means that firms can hire workers at low wage rates and thus reduce average labour costs.

Government

Reduced tax revenue: An increase in unemployment means that the government will receive less income tax revenue from the working population. This reduces the resources available for expansionary fiscal policies.

Higher welfare spending: Since more people are unemployed, it is likely that the government will have to spend more on unemployment related benefits, which could become costly.

Increased budget deficit: An increase in spending and a reduction in revenue can cause a budget deficit, and if in a surplus originally, can worsen the budget surplus.

Workers

Reduced income: When workers become unemployed, their income flows are shut off. This means that workers have reduced income and are unable to spend at rates they previously could cover with their wages.

Loss of skills: When workers become unemployed for large quantities of time, they may forget skills which are imperative in their field of work. This can make it more difficult when looking for a new job.

Incentive to retrain: If a worker becomes structurally unemployed, it is unlikely they will get another job that requires the same skillset as before. This may incentivise workers to learn new skills, and retrain for a potentially higher paying job.

Society

Deprivation: Unemployment causes deprivation in society, especially structural unemployment. This occurs, when large groups of individuals are made unemployed leaving large areas of people without incomes, this becoming deprived.

Increase in crime: When large groups of people become unemployed, some workers resort to crime to provide an income for themselves. This can severely increase crime in certain areas.

Balance of payments

Components of the balance of payments

Capital and financial accounts

The capital and financial accounts record cross-border transactions involving the purchase of financial assets and liabilities. If a current account is in a deficit, it is likely that a country will uses the capital and financial accounts to balance the balance of payments.

Current account

The current account involves the trade and income flows for a country. It is made up of the trade balance of trade in goods and trade in services, and primary income and secondary income.

Trade balance: The balance of trade in goods (tangibles) and services( intangibles) in an economy. It is found by Exports-Imports of goods and services.

Primary income (income balance): Primary income includes income earned from investments abroad, such as dividends and interest. This covers both primary income from abroad and primary income paid to foreign residents.

Secondary income (transfers): Secondary income involves one-way transfers between countries that do not include goods and services. This can include aid, remittances, and pensions.

Current account imbalances

Current account surplus: This is when the total amount of goods, services, income flows and transfers exported exceeds the total amount of goods, services, income flows and transfers imported.

Current account deficit: This is when the total amount of goods, services, income flows and transfers imported exceeds the total amount of goods, services, income flows and transfers exported.