Government policies and macroeconomic objectives

Macroeconomic objectives

The UK government has 4 main macroeconomic objectives which it attempts to achieve to achieve micro stability:

Economic growth: A sustained, high growth in real GDP, in the long run.

Low unemployment: A reduction in the proportion of people who are willing and able to work, that are not in employment.

Price stability: The Bank of England’s target rate is 2% per annum which aims to provide price stability to consumers and firms in the short term and long term.

Balanced current account: Avoiding large deficits in the current account, where import expenditure may substantially exceed export revenue.

The government also has other macroeconomic objectives that they attempt to achieve though they are not seen as essential to achieve compared to the others:

Balanced budget: Where government tax revenue is equal or close to government expenditure.

Greater income equality: A reduction in the gap between the highest income earners and the lowest.

Protection of the environment: Sustainable management of the environment without over-exploitation and negative effects on resources and the environment itself.

Government policies

Demand side policies

These are the policies that can be used by the government and the Bank of England to change aggregate demand and thus help achieve macroeconomic objectives. Expansionary policies aim to stimulate aggregate demand, whereas contractionary policies aim to reduce aggregate demand. Both increases and decreases in aggregate demand can be useful in achieving specific macroeconomic objectives. The two demand side policies are:

Monetary policy: Monetary policy is a set of tools used by the central bank to control the money supply and help achieve objectives and aims for example low inflation or economic growth. Note the Bank of England has absolute power over this policy, not the government.

Fiscal policy: Fiscal Policy is the use of taxation and expenditure by the government to help control economic activity. In government, the Chancellor of the Exchequer in the Treasury has the rightful power to employ this policy.

Monetary policy

The role of the Bank of England

The Bank of England is an independent financial institution that oversees the regulation of the monetary supply in the UK. By law, they have the sole legitimate use of monetary policy which its use is determined and enacted by the Monetary Policy Committee (MPC) who meet regularly to discuss whether interest rates should be increased or not. The MPC consists of nine people, with five from the central bank including the governor of the Bank of England, and the remaining four from independent institutions, mainly economists. The MPC aims to ensure the Bank’s target rate of 2% is met with the use of interest rates and quantitative easing.

The two instruments the Bank of England could employ to regulate the money supply are interest rates and quantitative easing. Both methods are effective in meeting macroeconomic objectives when employed, though offer drawbacks when meeting other objectives.

Interest rates

The interest rate represents the cost of borrowing and the reward for saving. The MPC can alter the official base interest rate to ensure price stability. This rate, known as the repo rate, is the fee charged by the Bank of England for short-term loans to other banks or financial institutions. Changes in the repo rate impact market rates offered by banks to individuals and companies, as the Bank of England acts as the lender of last resort. Banks may need to borrow from the Bank at the repo rate if they need funds, and therefore must ensure that their interest rates align with the repo rate to generate a reasonable profit. Raising the interest rate will cause a fall in aggregate demand via these four mechanisms:

- Raising the interest rate would increase the cost of borrowing for firms and consumers as a result causing a reduction in consumption and investment due to higher costs associated when making a choice to spend in the economy. A key example of this mechanism route is property. Consequently, higher interest rates increase the reward of saving due to higher returns on savings. As a result, consumers and firms are more likely to save as a result.

- As fewer people are borrowing and consuming, there is a reduction in demand for assets such as shares and government bonds. A fall in prices would occur causing a negative wealth effect to be enacted on consumers as the value of their assets would fall, as a result decreasing their consumption levels in the economy. In addition, firms are less likely to invest if prices are falling due to the growing chance of minimal profit on their investment. This decreases AD as both consumption and investment would fall.

- Consumers and firms will have lower animal spirits because of higher interest rates causing higher payments on purchases using borrowed funds such as mortgages. This will inevitably cause a greater proportion of their disposable income spent on these higher payments caused by the increase in interest rates leaving less income to be spent on other goods and services.

- The pound sterling would strengthen due to foreign investors being more willing to hold their money in British banks due to higher returns being guaranteed due to higher interest rates. This would increase the value of the pound which could increase import expenditure due to imports becoming cheaper and reduce export revenue as exports would be more expensive worldwide. This causes a reduction in the net trade, hence causing a fall in AD.

Disadvantages of interest rates

Despite interest rates being used significantly, especially when aggregate demand is too high to manage, it can lead to unintended consequences:

Worsening of the trade deficit: If import expenditure exceeds export revenue it may cause the economy to have a current account deficit which can be difficult to overcome.

Reduction in investment: If implemented for a long time, investment could be discouraged and hence a reduction in the LRAS of the economy may negatively impact economic growth.

Reduced effect: Lowering interest rates may not increase aggregate demand at all due to various factors such as the ability to stimulate demand. This has especially been the case in Japan’s economy, where its low interest rates have been ineffective in causing economic growth. This is known as the liquidity trap.

Quantitative easing

Quantitative Easing (QE) is where the Bank of England purchases assets with digital reserves, to increase the money supply in the economy. This increases liquidity around the economy and can be used to stimulate economic activity. This is an alternative solution to lowering interest rates which may be effective in stimulating demand in some cases and has been used in desperate scenarios e.g. 2008 Financial Crisis. QE tends to work through channels into the economy, for example in these four:

Asset price channel: As the central bank is purchasing financial assets, their demand increases, consequently causing an increase in their prices. This creates a positive wealth effect as these assets, held by alternative investors, will increase the value of their portfolios, increasing consumption and thus AD.

Bank lending channel: If financial assets are purchased from commercial banks, it may cause an increase in their bank reserves, which would enable banks to offer more money for borrowing which would further increase consumption and investment hence a stimulation in AD would occur.

Interest rates channel: If the central bank purposefully purchases long-term maturing bonds, it will increase the value of these bonds due to the rules of supply and demand. This means that interest rates will be pushed down in the long-term also, due to the inverse relationship between bond values and interest rates. Lower interest rates stimulate investment and consumption, thus further increasing AD.

Portfolio rebalancing channel: Central banks would hope, that supplying investors with liquid cash, in return for their low-yield earning financial assets, would stimulate demand for higher-yield investments. If it does, investors would rebalance their portfolios to seek higher returns, and thus generate higher income. Higher-income would then result in increased consumption and increased AD.

Disadvantages of QE

However, QE has its drawbacks and can be ineffective or detrimental if its usage is not efficient through these channels:

Hyperinflation: This may occur if the increase in the money supply does not match the demand in the economy. This has especially been seen in the case of the housing market, which has seen rapid price increases since the use of QE in 2008.

Increase in inequality: If QE works through the asset price channel, it may increase the wealth of rich investors thus increasing the gap between the wealthiest and poorest members of society.

Fiscal policy

This is a policy used by the Treasury which determines the level of aggregate demand in the economy. This is affected by the government’s expenditure and the rate of taxation applied to economic agents in the economy. Fiscal policy can be used in an expansionary and contractionary form to affect the economy:

Expansionary fiscal policy: This includes increasing government expenditure and reducing taxes. This stimulates aggregate demand as government spending is a component of aggregate demand, and a reduction in taxes leaves consumers and producers with more discretionary income/revenue, leaving more money left over for consumption and investment.

Contractionary fiscal policy: This includes reducing government spending and increasing taxes. This reduces aggregate demand because it results in less government spending, consumption, and investment.

Government budgets

The government's plan with its expenditure and taxation policies is revealed in the budget. Historically, this occurs twice a year, with Kier Starmer's labour government committing to just once a year. If government expenditure exceeds tax revenue, it is known as a budget/fiscal deficit. However, if tax revenue exceeds government spending, it is known as a budget/fiscal surplus. The UK normally operates in a budget deficit.

Distinction between indirect and direct taxation

Direct taxes: Taxes paid by the taxpayer which are directly received by the government. Examples include income tax and corporation tax which income earners and firms must legally pay.

Indirect taxes: Taxes where the supplier can pass on the cost to the consumer, and the tax revenue is indirectly received by the government. Examples include VAT (Value Added Tax) and excise duties. Pigouvian taxes (taxes that tackle negative externalities) are also indirect taxes.

Disadvantages of demand side policies

Negligible effect in the long-term: Classical economists argue for a perfectly elastic long-run aggregate demand curve, and increasing aggregate demand will only lead to a full inflationary effect.

Depends on the level of spare capacity: Keynesian economists argue that the effectiveness of a demand side policy relies on the amount of spare capacity there is in an economy. If an economy is at near full capacity, the effect of a stimulation in demand will be largely inflationary thus the effectiveness of the demand side policy is reduced.

Increase in unemployment: Although contractionary demand side policies may be effective in achieving certain macroeconomic objectives such as price stability, it is likely to reduce output thus reducing the rate of employment.

Supply side policies

Supply side policies are government-led policies designed to improve the productive capacity of the economy to achieve economic growth by improving the quality of certain sectors of the economy most notably the public sector which the government yields absolute control. Though the private sector can offer supply-side improvements such as through investment, arguably, by involving the government this increases the speed of these improvements.

Distinction between market-based and interventionist policies

Market-based policies: Policies that are designed to remove any barriers that prevent the free market from functioning efficiently, which causes higher prices and reduced output. This free market policy removes barriers such as the reduction of the willingness of workers to take jobs, high prices, and a lack of risk-taking and innovation.

Interventionist policies: Policies that are designed to correct market failures associated with the free market, such as underconsumption of education which is corrected by government funding, for all students to access. Also, firms may only willingly provide short-term investment to maximise profits leading to the government taking action to encourage long-term investment.

Examples of supply side policies

Increasing incentives

Increasing the incentive for people to work would strengthen and increase the country’s workforce and mean more goods and services being produced. The government can encourage this by:

- Reducing taxes and benefits, which would increase the opportunity cost of not working and increase the probability of being better off whilst at work.

- Supporting low-income earners from entering the poverty trap by offering income tax credits instead of them paying income tax which could help them be better off instead of being on benefits.

- The government can encourage certain parts of the workforce to return to work, such as offering women flexible hours when returning to a job.

- Reducing employer National Insurance Contributions (NICs), which would limit the amount of tax firms would have to pay when hiring staff, allowing them to hire more workers.

- Other reductions in taxes could enable firms to be able to take risks and invest more in the economy, leading to more output.

However, cutting taxes may not always be effective and may create unintended effects such as increasing income inequality if it is only certain income earners that receive cuts. Additionally, reducing taxes would mean the government would have less to spend on expenditure which could impact economic output and growth in the short-term.

Stimulating competition

Privatisation: The process of selling nationalised firms to the private sector, which are more efficient and likely to produce more output.

Deregulation: The reduction of legal barriers to entry into a market, thus allowing more firms to enter the market and increasing the level of competition in the market. In the long term, this may lead to more output

Promoting competition improves the efficiency of firms as they are more willing to provide more quality and lower priced goods and services to maximise profit and dominate market share. They are also more willing to be risk innovative to earn a profit unlike state-owned firms, which do not need to make a profit and thus are inefficient.

However, privatisation and deregulation do not always create positive effects with some markets seeing the emergence of monopolies and oligopolies which can affect competition in the market and thus limit the level of efficiency and output. This is especially the case in the UK energy market where only a small number of firms control the majority of market share which has led to heavy price increases for consumers recently partly due to supply shocks and just to generate profit. This can be managed if regulators such as the Competitive and Markets Authority (CMA) are formed, who can legally intervene and prevent anti-competitive behaviour in the market.

Reforms to the labour market

The government could make reforms to the labour market, which could increase the productive potential of the economy. For example:

Raising the retirement age: Raising the retirement age would limit the decrease in the country’s workforce size and thus more output can be achieved.

Reducing the National Minimum Wage (NMW): A reduction in the NMW would enable firms to employ more workers due to lower labour costs.

Weakening the power of trade unions: For example, the government could limit the legal number of days workers can strike or reduce the power of the trade unions to call strikes whenever they want. This can be effective as trade unions can help push up wages which may cause firms an increase in labour costs. This may force producers to make workers redundant and so would invest less due to lower profits being made.

While labour market reforms can improve workforce quality, they often encounter significant resistance from workers who feel their rights are being undermined. Such reforms may lead some workers to leave the workforce entirely, feeling exploited or disregarded, especially skilled professionals like doctors. These skilled workers may have chosen to exit due to weakened pay and conditions if trade unions become less effective. This potential "brain drain" could reduce the economy's productive capacity, limiting overall economic output.

Improving the quality of the labour force

Increased spending on education: The government could increase spending on education to provide a better quality of education for the workforce who as a result would be more efficient and work in higher-skilled jobs producing more goods and services. This could be through improving the quality of secondary education or providing retraining schemes.

Apprenticeships: The introduction of apprenticeships can improve workforce skills by providing higher-quality training. With subsidies, firms can employ skilled workers in more efficient roles, and regulatory measures can help ensure these opportunities are effectively implemented.

However, increasing the spending on education does not necessarily mean the quality of education increases in line. Arguably, there can be an opportunity cost as education expenditure could be spent on other sectors of the economy which may be more efficient in achieving economic growth. In addition, changes to the quality of education may take time to be implemented, and its effects from policies such as the Advanced British Standard (ABS) which will only be implemented in 10 years may not be seen for a long time.

Improvements in infrastructure

The government could boost the productive potential of the economy by increasing spending on transport and communication infrastructure. By improving the quality of transport and communication, commuting times and waiting times are likely to increase. In the long term, this can massively boost economic output.

Though improving infrastructure may assist in allowing a developed country to function, it arguably is expensive and can take a long time to see the intended effects. This is especially the case with the HS2 network, where the government had to cancel the Northern leg in 2023 due to excessive administrative costs which could not be financed by the budget.

Disadvantages of supply side policies

Price stability: Diagrammatically, an increase in the productive potential of the economy will reduce the price level. This may be harmful when trying to achieve the objective of price stability, especially if the rate of inflation is already below 2%.

Time lags: Supply side policies aim at achieving long-term economic growth, meaning that the effects of such policies may not be seen for long periods.

Opportunity costs: For most supply side policies, the government has to spend large amounts of money on improvements. This may create large opportunity costs on other areas of government expenditure unrelated to economic growth, such as defence.

Macroeconomic trade-offs between objectives and policies

Trade-offs between objectives

Economic Growth vs Protection of the Environment: As the country grows, more resources are used which could lead to over-exploitation of the environment causing damage to it. In addition, other negative environment effects can occur such as pollution and destruction of habitats which can affect the level of protection the environment has.

Economic Growth vs Balance of Payments: India has seen rapid economic growth meaning that there are very high levels of demand for products which has led to a rise in imports delivered into India, weakening its current account. In contrast, China’s economic boom has been spearheaded by its large exporting industries meaning that its current surplus has largely been a surplus.

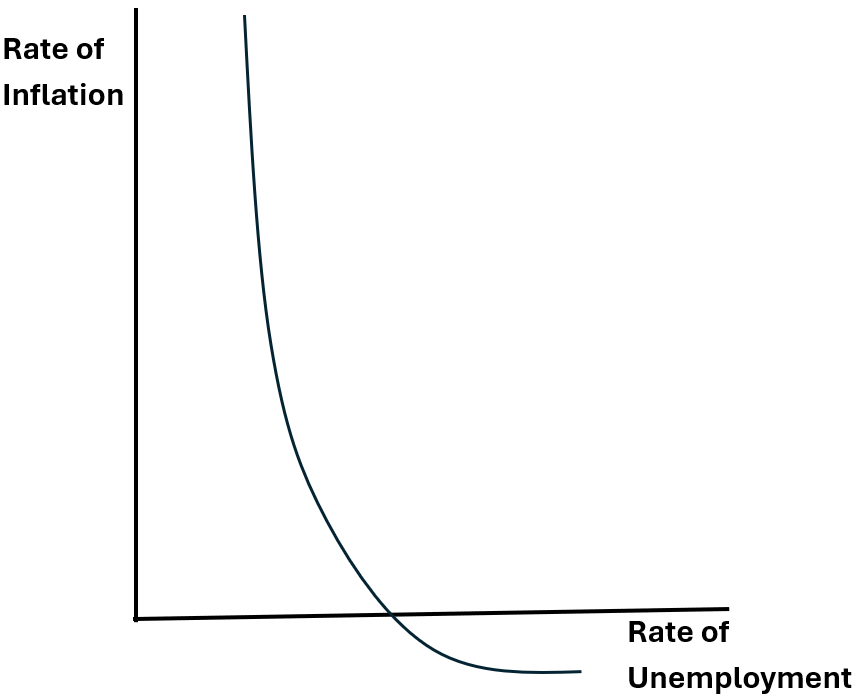

Unemployment vs Inflation: This was a trade-off investigated by economist A.W. Philips who examined that as the rate of unemployment falls, there is an increase in inflation due to firms passing on labour costs to prices paid by consumers. This theory was strengthened by how firms are willing to pay high wages for workers when there is full employment to attract them which contributes to an increase in the inflation rate. Similarly, this was the case when high unemployment, as firms found it easier to attract workers with lower wages due to the reduced income unemployed workers had in their pockets. This is explained through this diagram:

Though the reasoning and theory were economically correct, this model did not function as intended during the stagflation of the 1970s when there was high unemployment and inflation. Many reasons can explain why it failed but mostly it did not take account of the effect of prices on wages and instead only focused on the effect of wages on prices.

Trade-offs between policies

Expansionary and deflationary fiscal and monetary policies: Expansionary demand-side policies would boost AD, and increase output and economic growth but lead to increased inflation and worsening of the balance of payments. Deflationary demand-side policies may decrease AD to improve inflation but decrease economic growth and economic growth.

Changes in interest rates: An increase in interest rates would reduce high inflation rates though this could impact long-term growth due to the likelihood of lower investment due to higher costs of borrowing and spending. High interest rates can increase the value of the pound decreasing the value of imports but making exports more expensive, weakening the balance of payments. High interest rates could benefit savers who tend to be high-income earners who would see their wealth increase substantially, which could increase the inequality gap.

Fiscal deficits: To reduce this, the government may decrease spending and increase taxes which will reduce AD and decrease short-term economic growth and higher unemployment. The higher the fall in output may lead to a decrease in tax revenue reducing the effectiveness of the policy. In addition, this could reduce inequality as the poor are more likely to use government services so cuts in public sector spending will hurt them more.