Exchange rates

Exchange rates

An exchange rate represents the value of one currency in terms of another. Exchange rates are used when purchasing foreign currencies, so people know how much currency is worth a foreign currency.

How to express exchange rates

Spot exchange rate: This is the exchange rate that people use in the present time, which can change very regularly.

Forward exchange rate: This is an exchange rate that is agreed upon in the future. It is mostly used by firms, so they can forecast future costs at a guaranteed reliability.

Bilateral exchange rate: This is the exchange rate shown between two different currencies e.g. £1:$1.50.

Exchange rate index (EER): This index shows the exchange rates between one currency and a basket of currency, in terms of the percentage of trading that a country does with the foreign countries, which can give an indication of how strong the currency is in global trade.

Changes in the currency

Appreciation: This is when a currency strengthens in terms of another i.e. you can buy more foreign currencies with your own. This is only the case when the currency strengthens under a floating system, or due to the market forces of supply and demand.

Depreciation: Conversely to appreciation, this is when a currency weakens in terms of another i.e. you can buy less foreign currencies with your own. As with appreciation, this is only the case when the currency weakens under a floating system, or due to the market forces of supply and demand.

Revaluation: This is when a currency strengthens in terms of another. However, this happens in a fixed system where market forces are not in control of the currency.

Devaluation: This is when a currency weakens in terms of another. However, just like revaluation, this can only occur under a fixed system.

Exchange rate systems

Free-floating system

Floating systems are exchange rate systems that are determined by the market forces of supply and demand. Most countries including the UK have adopted a floating exchange rate system. The only things that can affect a free floating system is supply, demand, capital flows and trade flows.

Advantages

Decreased price distortions: If the currency's value is reflected by the true supply and demand of that currency, it can never distort the price mechanism, meaning there will never be excess supply or demand of the currency. This is important because distortions in the price mechanism can lead to extreme uncertainty in markets.

Automatic adjustments: If a country experiences inflation, a floating exchange rate can depreciate the currency, making exports more price competitive thus helping the economy to stabilise through export led economic growth, without the need for government intervention.

Reduced risk for peg failures: If a currency is pegged to a commodity, it may experience difficulties when the commodity fluctuates in value. By using a floating system, this risk is reduced.

Disadvantages

Market volatility: Due to vast amounts of supply and demand in the forex market, currency's can be subject to extreme scenarios where it is extremely volatile. This can lead to negative economic impacts such as decreased animal spirits or changes in export revenue/import expenditure.

Speculative attacks: A floating currency may be subject to speculative attacks, where large quantities of investors speculate that the value of the currency will decrease leading to a sharp drop in the value of the currency.

Difficulty in policy making: Using a floating exchange rate may give governments and central banks another problem to think about when using monetary and fiscal policies. This can create many macroeconomic trade-offs, when the government looks to achieve multiple objectives at once.

Managed floating

Managed floating systems are those where the currency is determined by supply and demand, however the central bank will intervene if the currency experiences severe shocks in value. Examples of countries who uses this are Brazil and Japan. This is advantageous because you experience the benefits of a free floating system, but can also avoid the costs such as large price spikes.

Fixed system

A fixed system is one where the exchange rates are determined by a central authority, by pegging a currency to a commodity or another currency to ensure the value does not change. This also means that central authorities are able to revalue and devalue currencies purposefully, which can be used to an advantage when trying to achieve macroeconomic objectives through import and export channels.

Advantages

Future stability: By ensuring that a currency will remain the same value, it can provide future certainty for industries who import raw materials for their production. This can increase animal spirits and thus boost the economy.

Inflation control: By pegging a currency to a relatively stable commodity or currency, it can help reduce the risk of regular imported inflation. This can help control monetary inflation.

Reduced speculative attacks: Since the value of the currency will never change, investors are less likely to target it for speculation attacks. However, this did not occur during the Asian Financial Crisis, 1997.

Disadvantages

Loss of sovereignty: If a country pegs their currency to another currency, they have to align their interest rates and money supply to the other currency to ensure the value of their currency stays the same. This can become disadvantageous when a country wants to use monetary policy to affect their own domestic economy.

Risk of overvaluation: If a currency becomes overvalued in the eyes of investors, even if it is pegged, it may result in severe speculation attacks. This occurred in the Asian Financial Crisis in 1997, leading to Thailand having to unpeg their currency and let it float.

Cost of maintaining currency value: To ensure a currency does not become over or undervalued and thus susceptible to speculation attacks, a country may have to use foreign exchange reserves to manipulate the supply and demand of the currency. This can prove to be very costly when a currency needs to increase or decrease in value hugely.

Factors affecting floating exchange rates

Floating exchange rates are influenced by changes in demand and supply of a currency. Below lists a number of factors that can change the demand or supply of a currency:

Demand of a currency

Demand for exports: When a foreign country wants to purchase goods from the UK, they may have to purchase pounds to be able to do so, leading to an increase in demand for pounds.

Level of investment into domestic institutions: If a foreign country wants to invest in UK assets, such as stocks, they may have to purchase pounds to be able to do so, which leads to an increase in the demand for pounds.

Level of speculation: If investors speculate that the value of a currency will rise, they may demand more of that currency in order to make valuation returns in the future.

Supply of a currency

Demand for imports: If a country demands more imports, it may have to sell its own currency to purchase foreign currencies to purchase foreign goods. This increases the supply of its own currency on the forex market.

Level of investment in foreign institutions: If the level of investment in one country reduces, its currency may become less useful, leading to many investors selling this currency on the forex market and increasing the supply of the currency.

Level of speculation: If lots of investors speculate that a currency will fall in value, they may sell the currency to reduce potential valuation losses, which can increase the supply of a currency on the forex market.

Government intervention in exchange rates

A countries' government can intervene into an economy to manipulate exchange rates. Some ways in which they can do this is through:

Use of interest rates: A government can encourage a central bank to change interest rates which in turn can manipulate the exchange rate. For example, if the Bank of England were to increase the base rate, the demand for pounds will increase, since the reward on saving in pounds would have increased. This increase in demand leads to an increase in the value of the pound compared to other currencies.

Use of gold and foreign currency reserves: A government can manipulate the value of a currency through the purchasing of gold and/or foreign currency reserves. By purchasing or selling gold and foreign currencies with their domestic currency, it can change the demand and supply of the domestic currency thus manipulating the value.

Competitive devaluation and depreciation: When using a fixed exchange rate, a government may choose to purposefully devalue their domestic currency. This will reduce the price of exports and make their export industries more globally price competitive. This can have beneficial economic impacts such as export-led economic growth.

Consequences of changes in exchange rates

Balance of payments (based of Marshall-Lerner condition): A change in exchange rates, more specifically a devaluation in a currency, can lead to a positive effect on the balance of payments, however this is only true if the Marshall-Lerner condition is satisfied (the PED of imports and exports is price elastic).

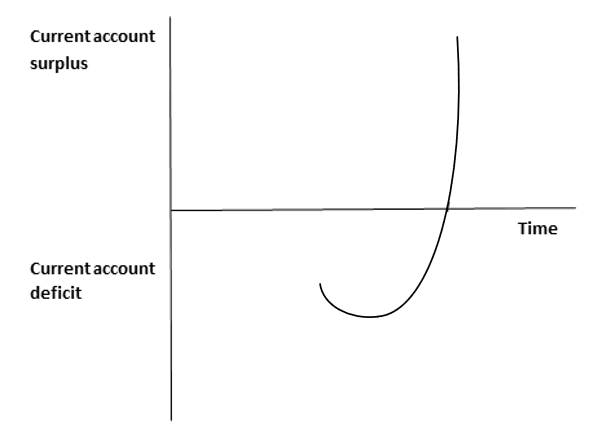

Balance of payments (based of J-curve): The J curve represents the process by which the current account changes after a currency devalues. Initially, when the currency devalues it will take a while for domestic consumers to realise that imports are becoming more expensive, and it will take a while for foreign countries to realise that exports have become cheaper and thus switch to them. However, in the long-term, the countries will switch to the devalued exports and consumers will stop purchasing imports thus resulting in a current account surplus.

Economic growth: A weaker exchange rate can make exports cheaper, thus stimulating the demand for exports. This can lead to export-led economic growth.

Inflation: A strong exchange rate can lead to cheaper imports. This can reduce imported inflation and thus bring down the general price level.

Foreign direct investment (FDI): A weak exchange rate can incentivise other countries to purchase more of your currency, and thus increase foreign investment.