An Introduction to Quantitative Tightening

Written by Luke Heritage

January 10th, 2024

Quantitative Tightening (QT) is a contractional monetary policy which aims to reduce the size of a Central Bank’s balance sheet1 or to reduce the money supply or liquidity2 in an economy. This financial protocol is typically carried out in a pair of ways. It is most commonly executed through the natural maturation of government bonds or by generating proceeds from their sale in the market. It can be used by Central Banks and is currently being used in the UK, by the Bank of England, and in the US, by the Federal Reserve. QT first commenced in the USA as early as 2017, however, it started to be used within the UK around February 2022, potentially used as a tool to combat the high UK inflation rates in 2022, when the Consumer Price Index (CPI) rose by 6.2% (February 2022). It is not seen as a conventional tool to combat inflation, but as mentioned before, the inflation rates have been so high, that QT may be able to cut the rates slightly. But the reason why QT most likely has to be implemented, is to reduce the ballooned balance sheet of Central Banks (2008 onwards) where they need to reverse the debt load that Quantitative Easing (QE) has created. Therefore, QT will become a useful policy in the coming years, depending on its ability to reverse the negative effects of QE.

Why are central banks using QT?

As stated before, QT can be used to combat inflation, essentially by reducing the money supply within the economy. By reducing the supply of money in an economy, it can reduce the rate of inflation, linking to a well known quote attributing to Friedman's ideologies of “Inflation is caused by too much money chasing after too few goods”. This means that the reduction in money may balance the quantity of money and the quantity of goods and services in an economy more evenly, providing more stable price levels i.e., less inflation.

The main contributing factor to the money supply requiring reduction is due to massive creation of money by the Bank of England since “The Great Recession”3 in 2008 using QE. QE aimed to stimulate economic growth in the UK economy by injecting money within the economy to encourage spending and consumption. This policy was needed to inject liquidity into the banking system in concert with the reducing of interest rates, to get the economy back into full flow.

QE is simply a mechanism where the Bank of England purchases gilts4 created by the government or mortgage-backed securities5, using money that they have digitally created, thus increasing the budget of the government who are the gilt issuers. This allows the government to spend more on the economy, which is a form of injecting money into the economy, and by doing so, the aggregate demand will theoretically increase. The gilts that the Bank of England purchased from the treasury, are stored in the Asset Purchase Facility (APF), and whilst the Bank of England earns yields off them. QT fundamentally aims to reduce the money supply in the economy, created by QE, reducing inflation in the process but whilst aiming to keep sustainable economic growth.

What is the process of QT?

As previously stated before, QT is a monetary policy aiming to control the money supply, but the process of QT can be executed in two different ways: Passive QT and Active QT. Both types of QT have the same final intentions, however, the speed in which it is executed, depends on which process is used.

Passive QT, or runoff, is an indirect policy aiming to result in a more contracted balance sheet. This is the process by which the central bank allows their bond holdings to mature i.e., they allow their government bonds to expire. When central banks allow their bond holdings to mature, they can write off the debt from their balance sheet, which in essence, is destroying money and therefore decreases the money supply in the economy.

Active QT is a more direct policy where intended measures are taken to contract the size of the Central Bank’s balance sheet more aggressively. The Central Bank sells its government bond holdings, which consequently reduces the size of its balance sheet, much faster than allowing the bonds to mature. The money supply will decrease because when the bonds are sold to the open market, high street banks use their reserves to purchase them thus reducing the money available to banks. Consequently, the lending capacity of high street banks is reduced, therefore, with less lending occurring the money supply is likely to decrease within the economy.

What method is the Bank of England using? And why?

As of November 2023, the Bank of England is using both types of QT to reduce the size of its balance sheet and reduce the money supply. We know this because of the governor of the Bank of England, Andrew Bailey’s letter to the Chancellor of the Exchequer, Jeremy Hunt, where he wrote “In September 2022, the MPC agreed that the Bank should reduce the stock of gilt purchases by £80 billion over the following 12 months, to a total of £758 billion. This would include the proceeds of maturing gilts and gilt sales”. This quote outlines that the Bank of England, are in fact using both methods of QT, to reduce its holding of gilts.

The reason why both methods are being used could be justified because the UK government tend to issue longer lasting bonds than other governments, such as the US. For example, the Bank of England hold gilts that will not mature until the early 2070s at the latest, however, the longest term treasuries6 that the Federal Reserve own, will mature in the mid-2050s. Hence, the Bank of England will have to wait much longer than the Federal Reserve for some of these bonds to mature.

Also, by using passive QT, it will take 7.8 years for the current bond holdings in the Bank of England’s APF to half, compared to a 4.4 year wait in the Federal reserve for their amount of bond holdings to. Therefore, waiting for these bonds to mature will be such a prolonged process for the Bank of England, meaning that no positive effects of quantitative tightening will be seen for a long time in the UK. Hence, they are speeding up the process to reduce the size of their balance sheet faster and by doing so, decrease the money supply. Therefore, the positive effect from QT is likely to be reached faster using its active form.

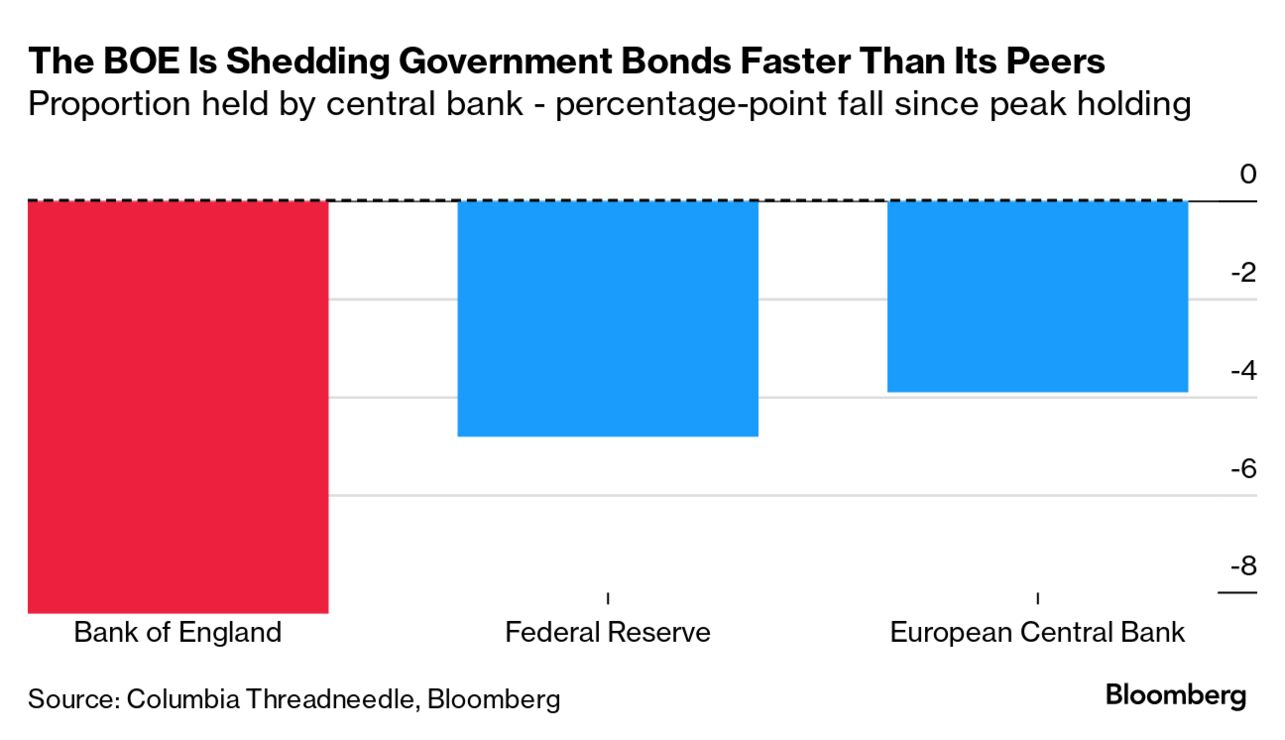

Source: Bloomberg, Columbia Threadneedle.

The graph shows the decline since the peak in the share of government bonds held by these central banks. The Bank of England is shrinking its holdings at a much faster rate than the Federal Reserve or the Eurozone. This allows for a faster effect developed from QT, but it could have negative effects if not controlled carefully.

Criticism of QT in the UK

QT has been described as a monetary policy that can provide advantages to the central bank and to the economy, particularly price stability. However, QT is likely to cause many negative effects which can create problems for the economy such as:

Interest Losses: The Bank of England sets a base interest rate which is 5.25% (As of November 2023), however, this is also the rate of which it borrows money at to fund its APF to stay open. Within this APF, gilts are stored which therefore earn the Bank of England a yield. However, with the current base rate being higher than the bond yields, it costs the Bank of England more money to fund the APF than it earns from the assets stored within the APF. This is therefore a massive cost of QT as the Bank of England is losing money on interest. QT will then worsen this negative effect as active QT increases the long-term interest rates, by pushing down the prices of bonds when too many are sold at once. Therefore, the interest loss is likely to increase when QT is in place.

Valuation Losses: As mentioned before, when active QT occurs, if gilts are flooding the market and too many are sold at once, it is likely to decrease the prices of gilts due to excess supply. Due to the inverse relationship between bond values and interest rates, the interest rates are likely to rise even more when bond prices drop, creating even weaker valued gilts. This creates a valuation loss because if the Bank of England are selling them for less than they bought them for, it generates a net loss.

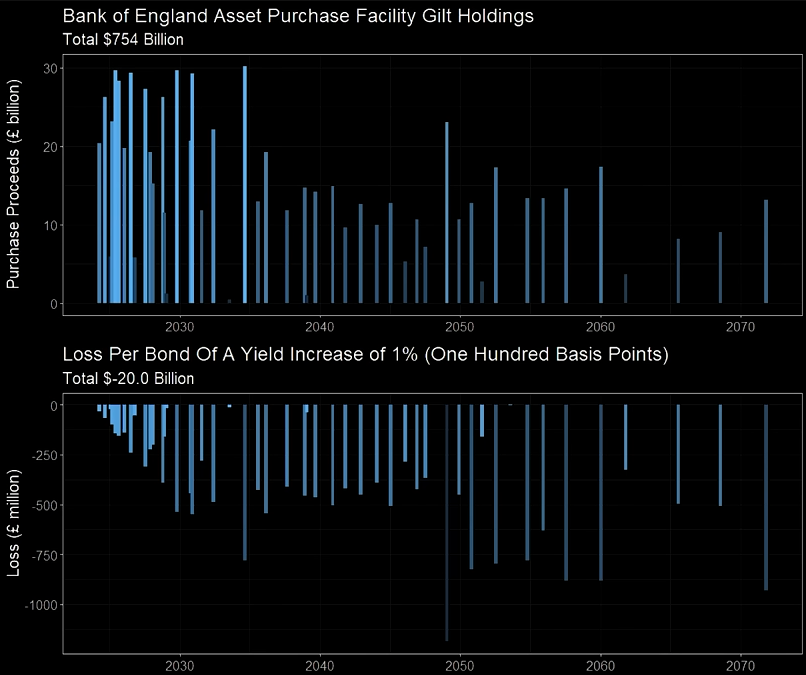

Source: Pensioncraft “Is the Bank of England crashing its own Bond Market?”

Above, shows a graph that represents the devaluation of every bond in the APF if the interest rates were to raise by 1%. A staggering $20 billion would be lost due to the devaluation of the gilts when interest rates rise, that the Bank of England hold. The loss that the Bank of England make however, is indemnified by the HM Treasury7, meaning that the UK tax payer is likely to incur a higher tax burden to cover the losses.

An alternative way of covering the loss is for the HM Treasury (more specifically the Debt Management Office) to issue more gilts, however, for the process of QT it creates regression, as the HM Treasury would need to sell even more gilts to cover the losses. With the nature of active QT increasing long-term interest rates, QT is likely to create further losses for the Bank of England. If the HM treasury decided to try to cover the losses in this way it is likely that a negative feedback loop would occur with continued issuance of Gilts to cover the losses in the APF.

A senior economist for Deutsche Bank, Sanjay Raja, estimates that the HM Treasury will have to indemnify the Bank of England for £49 billion this fiscal year, and £38 billion in the next fiscal year.

What is the Bank of England doing wrong?

Because of the approach to QT that the Bank of England are currently taking, they will inevitably have to sell some gilts. Therefore, they have the choice between selling short-term maturity gilts, and long-term maturing gilts. Due to the current devaluation of gilts, if they were to sell short-term gilts only, they would lose a value margin of around 5%. However, the sale of long-term gilts currently crystallises a loss of over 65%. This is a staggering difference, and it appears that there is only one single sensible option available.

The current Bank of England strategy is that they are choosing to sell both short-term and long-term maturity bonds into the marketplace. This strategy must be questioned as the losses that are being incurred from the sale of these bonds should be minimised as much as possible. However, it seems that because the Bank of England are indemnified by the HM Treasury, these large costs are insignificant to them. This leaves the UK tax-payer feeling the negative effects of QT and ordinary working people footing an enormous cost.

As mentioned before, an alternative way of covering the losses for the Bank of England, would be by issuing more gilts into the marketplace. But this runs counterproductive considering that the OBR estimates that now the APF is running down its gilt holdings, the private sector17 needs to absorb 6.5% of GDP in additional gilts each year over the next five years (the highest amount this century). It is unlikely that the private sector will absorb every gilt at the current price and this is where another problem is created, in that if too many gilts are sold at once to the private sector, the value of gilts is pushed down due to excess supply, creating further devaluation and therefore increases losses. This truly highlights the complication of QT and how it can cause so many negative impacts.

Conclusion

Overall, there is no clear-cut answer, as to whether QT will be successful because advantages and disadvantages can arise from it. On one hand the reduction of the APF could create a Doom Loop18 in the UK economy at a time that the population need successful policies that will provide a foundation for economic growth. On the other hand, it is possible that QT could help reduce inflation and thus reduce interest rates creating pressure on yields which in turn could reduce or even reverse APF interest losses.

The future success of QT looks to be highly subjective as of now because if it does succeed in fulfilling the Bank of England’s objectives, it may harm third parties such as the working population. Therefore, it is entirely possible that the government may look for other policies to reverse the negative effects of QE. At present, QT is the policy in use, and will hopefully achieve the objective that the Bank of England have used it for.

Footnotes

- Balance Sheet: A financial sheet that represents the financial position of an entity at that time. It usually consists of assets and liabilities.

- Liquidity: the degree of speed by which an asset can be bought and sold in a market, whilst avoiding a fluctuation in its price.

- The Great Recession: Refers to a global economic turndown that started in 2007 which was caused by a Financial Crisis.

- Gilts: UK government bonds.

- Mortgage-Backed Securities: A financial asset that represents the ownership of loans that were taken to purchase a property.

- Treasuries: US government bonds.

- HM Treasury: The section of government responsible for overseeing the UK’s finances.

Bibliography:

Bank of England Market Operations Guide | Bank of England

Consumer price inflation, UK: February 2022 | Office for National Statistics

Doom Loop: Definition, Causes, and Examples | Investopedia

Economic and fiscal outlook – March 2023 | Office for Budget Responsibility

Explainer: The Fed's new 'QT' plan takes shape | Reuters

Letter from the Governor to the Chancellor - April 2023 - APF | Bank of England

QE and QT explained | FundCalibre

Quantitative Easing Explained | Forbes

Quantitative Tightening | Investopedia

Quantitative tightening: the story so far−speech by Dave Ramsden | Bank of England

The Bank of England is rushing to sell its gilts. For investors, this could be an opportunity | Columbia Threadneedle Investments

What is Quantitative Tightening? | Economist

Bank of England Crashing Its Own Bond Market! - PensionCraft | Youtube

BOE Choices Are Making It Harder for Hunt to Spur UK Economy | Bloomberg